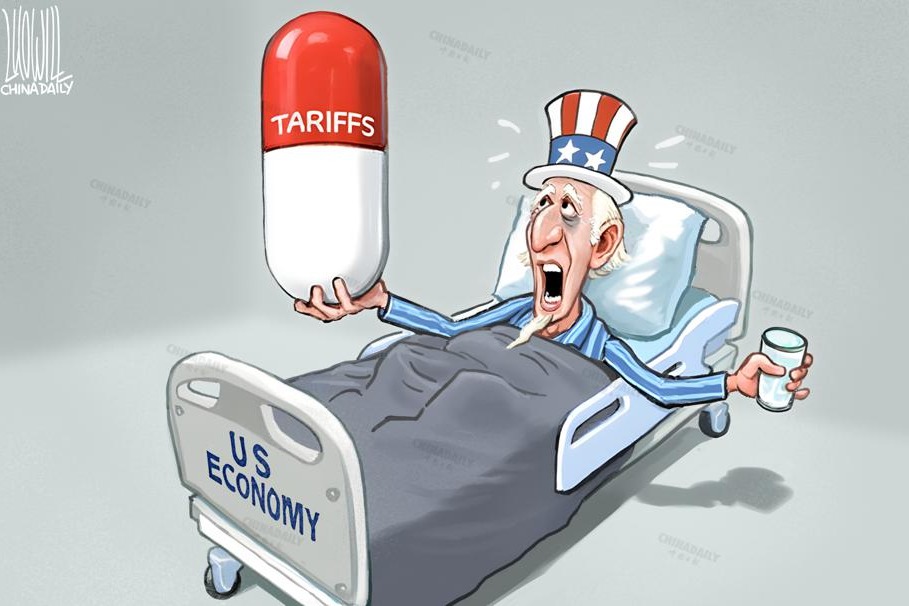

Still work to do

Past experience indicates the Chinese economy has the resilience to overcome the current challenges with the right policies

I wrote in my column in February that "the outbreak of the novel coronavirus and the extraordinary official measures to contain it have hit China's economy hard. No one knows, as yet, when the authorities will manage to overcome the epidemic, and what the eventual cost to the economy will be. But the Chinese people have, once again, shown courage and solidarity in the face of a national emergency. There is no doubt that China will win the battle against COVID-19".

I am glad to say that my optimism stands vindicated. Even while implementing a strict social distancing policy at huge economic and social costs, the government devised ways to help businesses survive the crisis, focusing in particular on providing support for small and medium-sized companies in the service sector.

The fiscal measures China has adopted while combating the virus have included cutting taxes and reducing the administrative fees for companies, exempting companies from paying social security premiums or granting them grace periods, providing subsidized loans, covering all the costs for the testing and treatment of COVID-19 patients and setting up relief funds to provide assistance. Monetary policy measures have included lowering refinancing interest rates, providing targeted low-cost special loans, reducing reserve requirements and lowering interest rates on excess reserves, among other things.

China's strict prevention and control measures meant the spread of the novel coronavirus in the country was largely brought under control in early April, which was marked by the lifting of the lockdown on Wuhan, capital of Hubei province. China's success, apart from its well-functioning administrative machinery, is attributable to the Chinese people's solidarity, sense of social responsibility and discipline. The economy bounced back from a growth rate of minus 6.8 percent in the first quarter of 2020 to 3.2 percent in the second quarter. China's V-shaped economic recovery could continue, with the economy posting a full-year annual growth of 2.5 percent.

The International Monetary Fund forecasts that China will be the only major economy to grow at a positive rate in 2020; and it predicts it will register GDP growth of 8.2 percent next year. Perhaps, the 2021 forecast is too high, but something like 6 percent growth should be attainable.

However, the challenge before China in 2020 remains Herculean. For a 2.5 percent growth rate, the economy has to grow at 6 percent in the second half of 2020. That will require a strong demand boost, the lack of which has impeded China's growth for years. The pandemic has only further constrained demand.

Consumption, which accounts for 55 percent of China's GDP, fell by 3.9 percent in terms of social retail sales in the second quarter, and by 2.9 percent in June, compared with the 19 percent decline in the first three months of 2020.

Car sales in the second quarter were particularly strong. Mercedes-Benz said its "best second quarter to date in China shows the impressive speed at which demand is currently recovering in our largest market".

Such encouraging signs have prompted some to suggest that consumption will surge and become the main growth driver for the rest of the year. Unfortunately, that is unlikely to happen, because households will be anxious to replenish the savings they depleted during the lockdown. The government can and should provide relief to households affected by COVID-19, but it cannot do much to stimulate consumption.

Although fixed-asset investment turned only marginally positive in the second quarter, it was a significant improvement on the 16.1 percent contraction from January-March. A back-of-the-envelope calculation suggests that, given the likely growth rates of consumption and net exports, fixed-asset investment would have to increase at a double-digit rate in the second half of 2020 for the economy to grow by 2.5 percent as a whole.

However, the only way for fixed-asset investment to show double-digit percentage growth in the second half of 2020 is for infrastructure investment to grow even faster. Last month, investment in infrastructure rose 6.8 percent year-on-year. Though encouraging, that's not enough. The Chinese government needs to adopt a more expansionary fiscal policy to finance infrastructure investment. But in doing so, it will encounter a dilemma.

When the Chinese government announced early this year that it was aiming for a total budget deficit of 3.76 trillion yuan ($540.9 billion), equivalent to 3.6 percent of GDP, it assumed that nominal GDP would grow by 5.4 percent. This is now obviously unrealistic, so budget revenues will be lower than forecast. And if the government does not cut expenditure, China's fiscal position may worsen rapidly in the second half of 2020.

But if the government decides to reduce spending to prevent the deficit from increasing, the economy may grow by less than 2.5 percent, making it impossible for China to create as many jobs as planned. Meaning that if China loosens fiscal policy, public finances will worsen significantly; if it cuts expenditure to offset the revenue shortfall, growth will be lower, with dire consequences.

Therefore, the country should be firm in adopting an expansionary fiscal policy aimed at accelerating economic growth. The government should issue more bonds to finance additional infrastructure investment, and the People's Bank of China should adopt various policy measures to facilitate this, including implementing quantitative easing if necessary.

The resulting problems-a worsening fiscal position and a rising debt ratio-can be dealt with later. Chinese policymakers should never forget Deng Xiaoping's famous maxim that "development is the only hard truth". And right now, China urgently needs a growth boost.

The Chinese economy is very resilient. Experience over the past 40 years shows that whatever difficulties it faces, China will eventually overcome them. It will do so again this time

The author is a senior fellow and member at the Chinese Academy of Social Sciences. The author contributed this article to China Watch, a think tank powered by China Daily.

The views do not necessarily reflect those of China Daily.