Green Belt and Road guider

China can demonstrate the positive links between climate action and sustainable economic development through its foreign investments

China's engagement in the climate agenda is usually viewed through a domestic policy lens. Analysis tends to focus on the country as a source of climate risk given its status as the world's largest emitter of carbon dioxide, and on the opportunities that come with its potential transition from a carbon-intensive manufacturing growth model to a more sustainable path.

A sometimes-overlooked dimension relates to its influence in promoting climate objectives internationally. This is becoming increasingly important as its economic ties with the rest of the world intensify. Once a peripheral player in the global financial system, China's presence has grown substantially over the past two decades, and it is now one of the world's largest creditors and providers of sustainable development finance, with a net international investment position of $2.15 trillion, according to our paper titled Internationalism in Climate Action and China's Role. Institutions such as the China Investment Corp have invested extensively in foreign real estate and infrastructure, as well as in equities.

The geographical distribution of these investments reflects a growing focus on emerging markets, particularly countries involved in the Belt and Road Initiative. However, the track record of these investments in terms of environmental, economic and debt sustainability has at times been called into question. For these economies, financial partnerships with China are poised to become more relevant as they begin to chart their own paths to sustainable development. Many of the countries participating in the Belt and Road Initiative are roughly where China was two decades ago in terms of income per capita, with great potential for rapid growth. If they follow a traditional approach to development with a narrow focus on physical capital accumulation fueled by the extensive use of fossil fuels-polluting first and cleaning up later-the consequences for the whole world would be devastating.

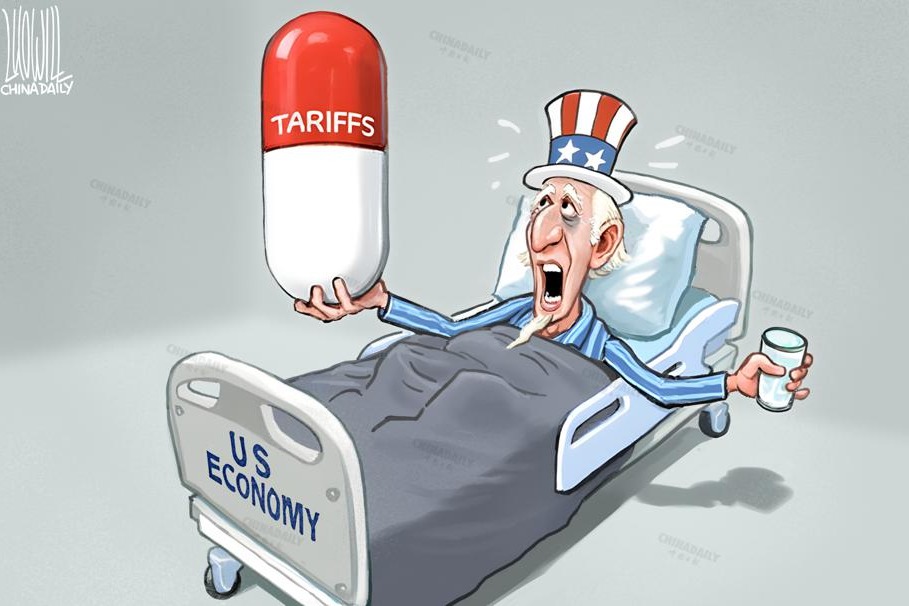

A combination of shifting public attitudes, changes in policy and regulation, and the acceleration of the climate crisis means that climate change is becoming an increasingly relevant factor for the economy and financial system, and is directly affecting the financial value of many assets. Regulators have warned of a climate "Minsky moment" if investors' expectations about future climate policies change sharply, causing a major collapse in asset values and a spike in borrowing costs. This would be particularly problematic in today's global macroeconomic environment as we begin to slowly exit from the extremely benign liquidity conditions and accommodative central bank policy that have characterized the past 20 years.

In response to these risks, investors are adjusting their portfolios. For example, many are gradually reducing exposure to fossil fuel industries or using their shareholder rights to steer them in more sustainable directions. These methods can be instructive to sovereign investors, too. Chinese institutions that act as foreign investors and creditors should look to deploy climate risk management tools to address their foreign portfolios' exposure to climate-related risks. This includes sovereign debt contracts-entire countries can be exposed to both physical and transition climate-related financial risks.

Neglecting to carry out these assessments would mean that China's foreign investments do not deliver the investment returns and economic development benefits to their full potential. It would also create vulnerabilities and credit risks for China in its position as a creditor: creditors that remain exposed to climate-related risks could face hits to their portfolios as the urgency of the transition grows.

Reflecting these motivations to embrace sustainability in its foreign investments, China's strategy for international cooperation should seek to minimize the risk of climate-related debt crises.

This requires working with them bilaterally to support sustainable economic development through investments that promote climate change mitigation and adaptation. It also requires acting together with global partners to enhance debt sustainability through joined-up creditor thinking and action.

Overall, actions should be guided by three priorities.

First, engagement with governments, institutions and companies in the countries to which it lends. Active shareholder engagement strategies are becoming increasingly seen as more effective than divestments and blunt exclusions in terms of impact. Chinese institutions should look to leverage their positions as creditors to influence policies and decisions by those to whom they lend toward more sustainable and climate-aware forms of economic growth and development.

Overseas investments that effectively support the transition to a sustainable, low-carbon economy primarily powered through renewable energy should be the top priority. Such investments should be delivered within a framework of high environmental standards, for example through establishing negative lists and guidance directories for investment. The Belt and Road Initiative Green Investment Coalition and the Green Investment Principles are good examples of this.

Second, engagement with fellow creditors. China should strive to work more actively and closely with the international multilateral system in supporting debtor countries during times of debt distress, especially in cases of debt restructuring with multiple creditors. Arrangements to support debtor economies such as the G20's Debt Service Suspension Initiative and its successor the Common Framework will be particularly critical in the aftermath of the COVID-19 pandemic, which has elevated the debt burden for many emerging and developing economies to which China lends. The present system is hampered by a lack of international standards for sovereign debt lending, which can be problematic in terms of the discretionary nature of resolving individual cases of enforcing sovereign debt contracts.

Third, multilateral climate action. China should continue to engage in the multilateral system through participating in initiatives that promote sustainability and mitigate the global risks from climate change. Deepening its participation in initiatives in which it is already a member (such as the Network for Greening the Financial System or the G20 Sustainable Finance Working Group) and joining new ones (such as the Coalition of Finance Ministers for Climate Action) would not only respond to criticism that China's foreign lending practices risk locking countries into carbon-intensive futures, but also enhance China's own economic prospects in enhancing the credit risk profile in its loan book.

The author is a senior policy fellow at the Grantham Research Institute on Climate Change and the Environment at the London School of Economics and Political Science.