Stock market may stabilize more on rules

Insiders laud regulator's curbs on short-selling, tighter scrutiny of trading

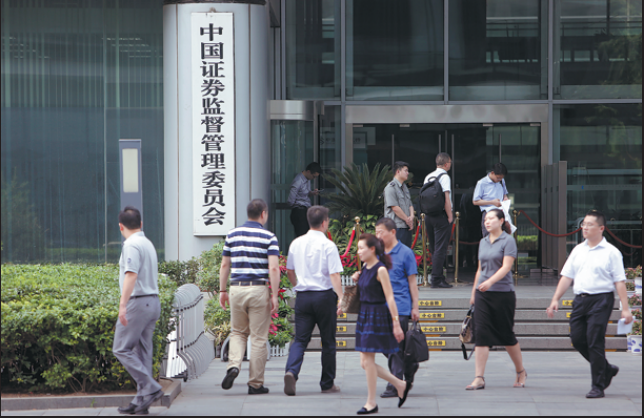

China's A-share market performance and investor sentiment will stabilize as financial regulators step up efforts to improve market fairness and advance the high-quality development of the capital market, said experts and insiders.

They made the comments after the China Securities Regulatory Commission, the country's top securities watchdog, announced late Wednesday more curbs on short-selling and tighter scrutiny over high-frequency trading.

According to the CSRC announcement, securities relending, in which brokers borrow shares for clients to short sell, have been suspended from Thursday, while existing contracts must lapse by the end of September. Stock exchanges will raise the minimum margin requirement from 80 percent to 100 percent for short-selling, and the bar will be higher for hedge funds.

The balance of securities lending in the A-share market is around 31.8 billion yuan ($4.4 billion) now, down from 71.6 billion yuan at the beginning of the year. The balance of relending securities has declined to 29.6 billion yuan, as the CSRC has already halted new relending securities in February, explained Xu Kang, chief nonbanking analyst at Hua Chuang Securities.

Market sentiment will be boosted amid the CSRC's tightened grip, he said.

Lin Yixiang, chairman of TX Investment Consulting, applauded the CSRC's announcement, saying that some shareholders used to make private placements by incorporating short-selling. This practice used to create huge profits for them and they took advantage of the independent and globally accepted trading mechanism. This has impaired the interests of individual investors. The latter make up more than 90 percent of the A-share market investors and account for around 10 percent of total market capitalization.

"At this moment, only by adjusting the trading rules or product designs, which are most closely associated with the stock market, can the A-share market rise significantly," he said.

The stock market responded positively on Thursday with the benchmark Shanghai Composite Index ticking up 1.06 percent to close at 2970.39 points and the Shenzhen Component Index jumping about 2 percent. The total trading value on the Shanghai and Shenzhen bourses approached 800 billion yuan, up 17.6 percent from Wednesday.

Wei Wei, chief strategist at Ping An Securities, wrote in a note on Thursday that the CSRC's latest moves have shown the regulator's intention to safeguard fair trading. From the short-term perspective, the new measures will boost market confidence and stabilize the A-share market that has hovered over the historic low since June.

For the long run, more deepened reform policies can be expected from the upcoming third plenary session of 20th Communist Party of China Central Committee. Combined with the nine new measures introduced by the State Council, China's Cabinet, in April to advance the capital market's high-quality development, structural opportunities will increase in the A-share market, he said.

Deepened institutional reform in the financial sector will likely be stressed at the meeting, said Qiu Xiang, joint chief strategist of CITIC Securities.

There will likely be a more stringent grip over the entry and exit of capital market players. Efforts will be made to increase returns for investors. The introduction of more medium- and long-term capital will be underlined, he said.

Trading activity will pick up amid rising market liquidity after the meeting, he said.

The development of new quality productive forces, including the upgrade of traditional industries and the development of strategic emerging industries, optimized allocation of resources and further opening-up may be underscored in the meeting, said Chen Guo, chief strategist at China Securities.

Eugene Qian, chairman of UBS Securities, said that the development of new quality productive forces requires a more investor-friendly investment environment, smoother financing channels and a larger number of institutions focusing on long-term investment. This will help address the weak links in the Chinese capital market, he said.

- Top 10 countries attracting Chinese tourists during upcoming summer vacation

- China's landmark trade corridor drives growth in glass industry and global trade

- Instant retail sizzling as turf war among big names heats up

- Top 10 innovative cities in China

- Top 10 favorite gift brands of rich Chinese women