Fed obliged to consider spillovers when adjusting monetary policy

In its latest Federal Open Market Committee meeting that concluded on Wednesday, the US Federal Reserve Board cut interest rates by 50 basis points, the first rate cut since March 2020.

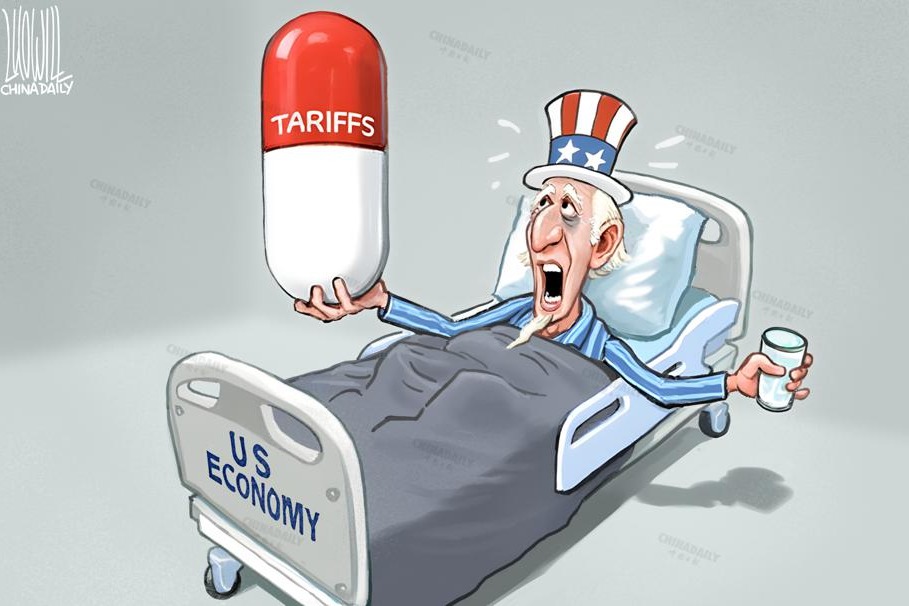

The Fed raises or cuts rates to control prices, promote employment and regulate the economy. In response to the impacts of the COVID-19 pandemic on the US economy, the Fed cut rates by 1 percentage point in March 2020. To counter high inflation arising as a result of the United States disrupting global supply chains and fueling geopolitical tensions, the Fed embarked on a cycle of aggressive interest rate hikes in March 2022, and has kept its policy rate at 5.25-5.5 percent since July 2023.

As recent data show that inflation in the US has fallen below 3 percent, close to the 2 percent target the Fed had set, expectations of a Fed rate cut had been growing. The slowed economic growth and the rise of the unemployment rate to 4.2 percent from 3.4 percent in early 2023 could be other reasons for the latest rate cut.

Any monetary policy change in the world's largest economy affects not only the US economy, but also has a profound impact on the world economy, and the latest rate cut is expected to have important ripple effects on international markets, trade, capital flows, and the global financial system.

The rate cut and the expectation of further rate cuts mean the end of the era of a strong US dollar. As far as China is concerned, the impact of the expected Fed rate cuts remains to be seen. However, it will to some extent alleviate the pressure on China's monetary policy and give it more space to cut its interest rates, helping bolster China's slowed economy. However, while helping lower the prices of imports, a weaker dollar will also raise China's export costs. At a time when exports remain important for its economy as China's domestic demand is still low, this is bound to weaken the competitiveness of China's exports and may add to its supply excess. China should flexibly use its policy or other tools to cope with any possible impacts, to achieve economic stability and sustainable development.

Any responsible major country, when adjusting domestic economic and monetary policies, should consider not only its own interests, but also the impact on other countries. We hope the US will keep the broader picture in mind while making monetary policy adjustments.