US-China e-commerce ties face tariff hurdles

Supply chain disruptions warned amid uncertainty over cross-border business

As the United States ramps up tariff pressure on Chinese imports, industry leaders and trade experts are warning of rising inflation, supply chain disruptions and challenges for the thriving cross-border e-commerce sector that has connected consumers worldwide with China's manufacturing strength.

At a recent panel discussion on trade and digital commerce, Wang Mingming, CFO of Thunder International Group, an e-commerce logistics firm in California, emphasized the urgency of transparency and innovation in helping clients navigate changing trade policies.

"The tariffs have been dramatically changing the trading world, especially international trading," Wang told the forum hosted by US venture capital firm Plug and Play.

"But I would say the supply chain in the East Asian market is there, and some of it is non-replaceable and can't go back."

Wang said many e-commerce sellers and factories had already shipped goods via ocean freight and are using every available customs clearance channel to store products in fulfillment centers in California.

Ranked the world's fifth-largest economy, California offers a favorable policy environment for businesses, including e-commerce. "So we should be very confident that e-commerce trading is still a way that can boost the economy here," Wang said.

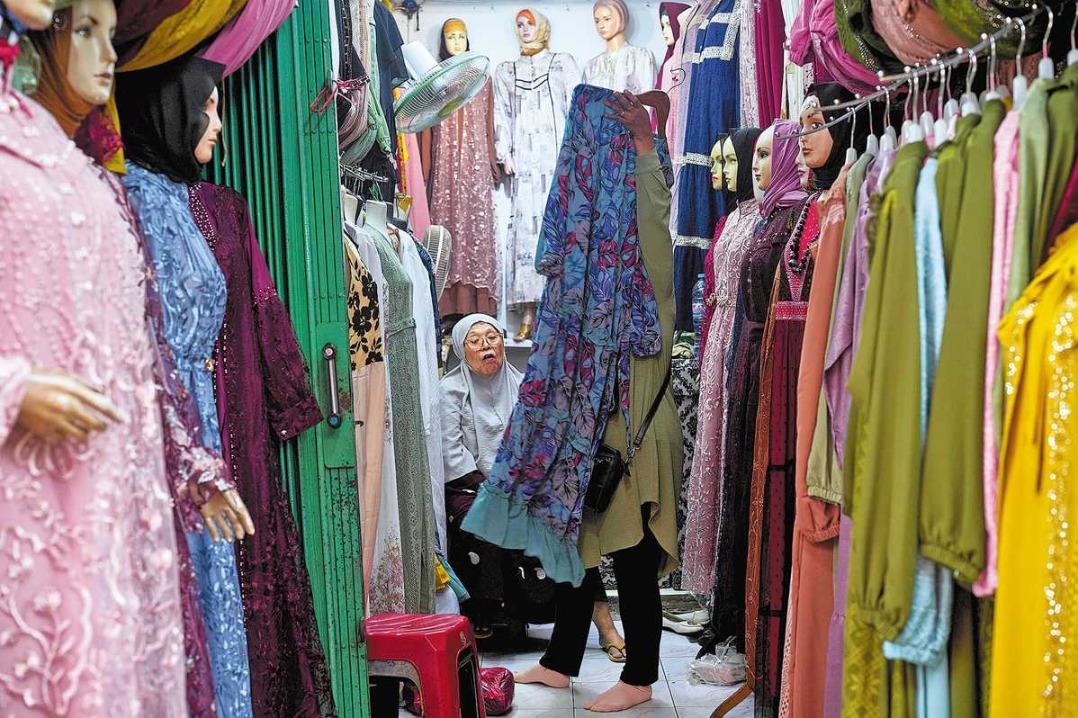

At the heart of this sector's expansion are China's leading digital platforms — Shein, Temu, AliExpress and TikTok Shop — dubbed the "four little dragons" for their rapid global rise. Known for ultra competitive pricing and agile supply chains, these platforms have surged in popularity, attracting global consumers with low prices and free shipping on orders as small as $10.

Vivian Sun, head of business development at Shein Marketplace, emphasized the mutual benefits of global e-commerce expansion.

"We have hugely loyal customers in the US because we are giving them choices and prices that keep them coming back," she said. "That's why we partner with local merchants to offer products to millions of shoppers across the globe."

Founded in 2012, Shein has evolved into a retail giant serving more than 150 countries, with more than 20 offices and 16,000 third-party sellers. It has invested heavily in social commerce, supplier support and community programs to stay competitive.

However, the US government's imposition of high tariffs on Chinese goods, alongside additional duties targeting other trading partners, has cast a shadow over the continued growth of China's leading e-commerce platforms.

"I've been hearing about the story that the retailers canceled the orders for the factories through their FOB (Free on Board) orders," Wang said. "They will be affected dramatically due to the tariffs."

Geopolitical fabrics

Officials have warned that punitive tariffs could strain both the economic and geopolitical fabrics connecting the US and China.

"More importantly, cross-border e-commerce is enabling small- and medium-sized enterprises, startups and entrepreneurs from both China and the US to break past traditional boundaries and directly reach each other's consumers," said Xie Xin, science counselor at Chinese Consulate General in Los Angeles.

Xie acknowledged the current tensions and urged collaboration.

"If we let these issues lead us toward further decoupling of commerce and trade, I don't believe that is the original intent of either side," he said. "If we reach a point where trade no longer exists, then even the highest tariffs will ultimately amount to zero."

Feng Ye, CEO of Thunder International Group, warned that continued tariff hikes could intensify inflation in the US.

"Inflation in the US is already a serious issue, and raising tariffs will only exacerbate it," Feng told China Daily. "Ultimately, if everyday consumers lose their purchasing power, they may simply stop spending altogether — 'lie flat', so to speak."

Feng pointed to signs of weakened US consumer behavior and the rise of "consumption downgrading".

"US consumer spending is already showing signs of weakness. That's one reason why ultra low cost platforms like Temu have been able to quickly gain market share. People are choosing cheaper alternatives — they simply don't have the same level of disposable income anymore."

Kenneth Byrd, executive director of Byrd Immigration Law Group in Los Angeles, said worsening trade ties may also have a ripple effect on immigration patterns. "If we cannot have commerce between the two countries, then the next step will be the people will stop coming as well."