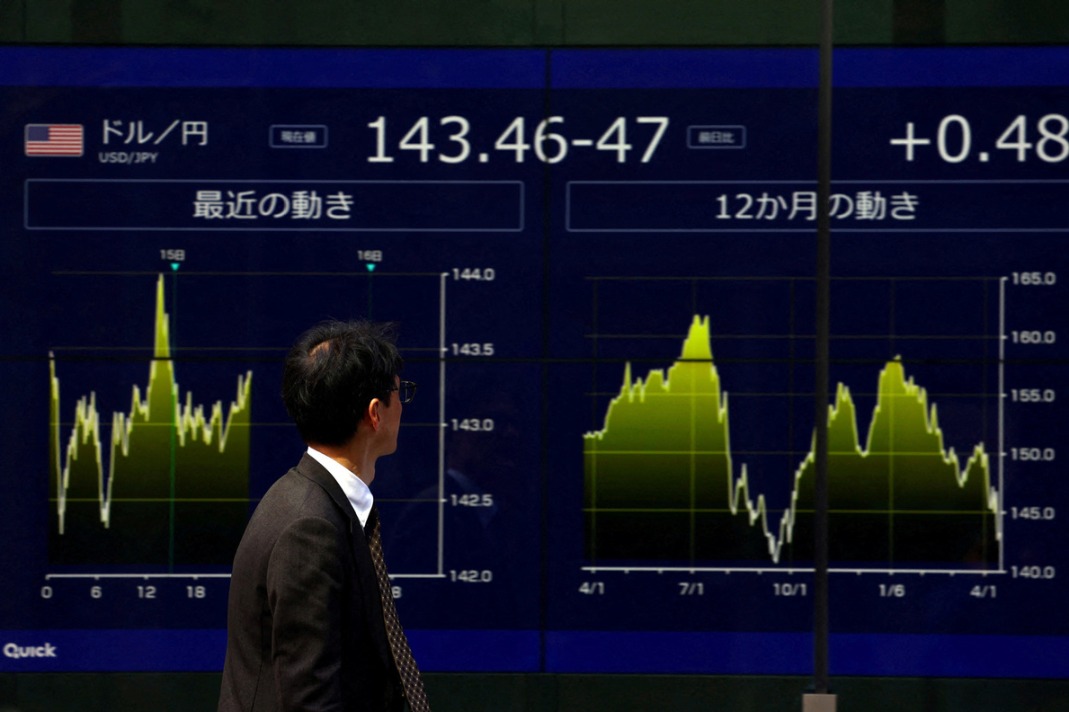

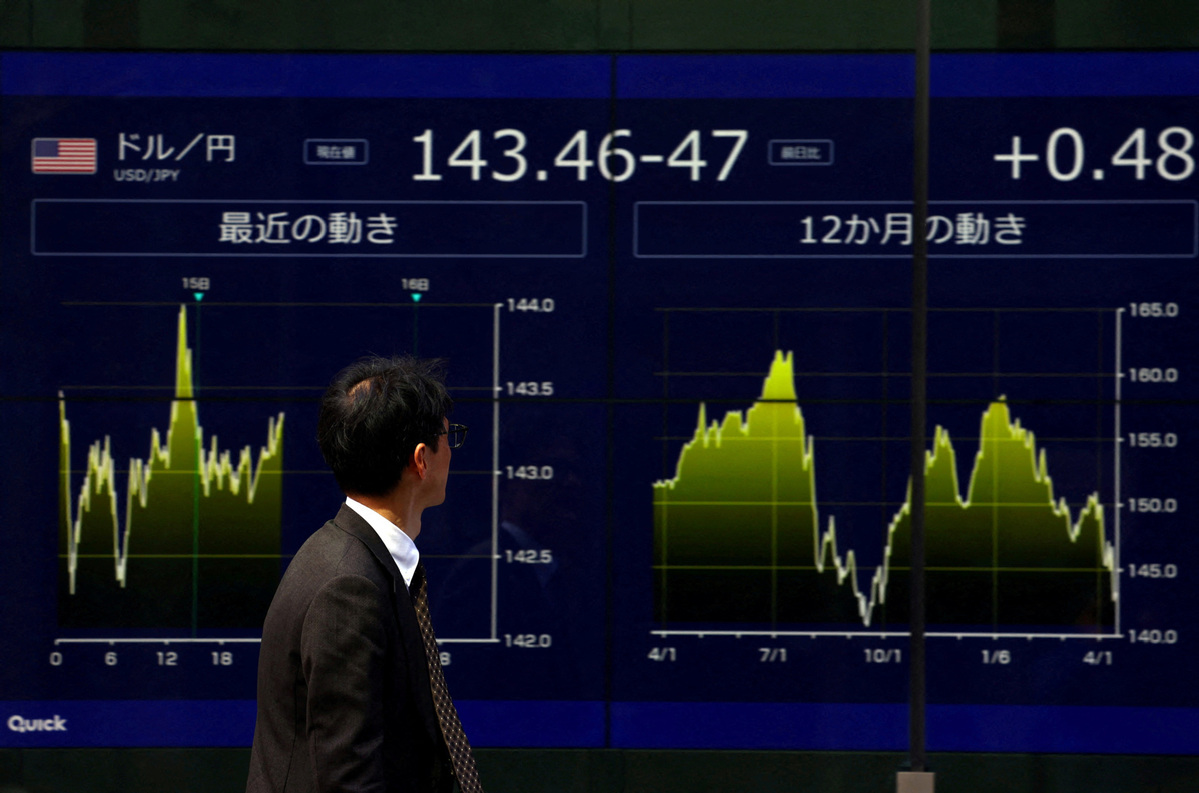

Yen strengthens against US dollar amid tariff talks

The yen temporarily climbed into the 140-yen range against the US dollar on the Tokyo foreign exchange market on Monday, reaching its strongest level since September 2024.

Growing uncertainty in US financial markets has fueled demand for the yen, while expectations that currency issues could surface in Japan-US negotiations over the Trump administration's tariff policies have added further upward pressure.

Japanese Finance Minister Katsunobu Kato and US Treasury Secretary Scott Bessent are making arrangements to meet in Washington, DC, on Thursday local time, Nikkei reported. Investors are selling the greenback on speculation that Bessent, who is leading the US side in tariff talks, might raise currency matters alongside non-tariff barriers such as automotive safety standards.

US President Donald Trump has long viewed the weak yen and strong dollar, which he sees as disadvantaging American exports, as a problem. Whether Bessent brings up currency in the ongoing tariff talks will be a key point to watch.

Kato is also expected to attend the G20 Finance Ministers and Central Bank Governors' Meeting, which will begin in Washington on Wednesday local time. His meeting with the US treasury secretary is expected to take place on the sidelines of this visit.

Bank of Japan Governor Kazuo Ueda said on April 14 that both global and domestic economic uncertainty has risen significantly as a result of US tariff policies.

Contact the writers at [email protected]