Washington whines as Ottawa bans wines

The US wine industry is facing new pressure as several Canadian provinces ban US alcohol — a decision that could deeply affect US exporters, experts said.

Robert Eyler, an economics professor at Sonoma State University and an expert on the wine industry, said Canada remains a key export destination for US wine, accounting for roughly one-third of all US wine exports.

"Canada has been a consistent, lower-cost logistics market for US wine producers annually," he told China Daily.

Eyler said Canada's actions could send ripples through the US wine industry.

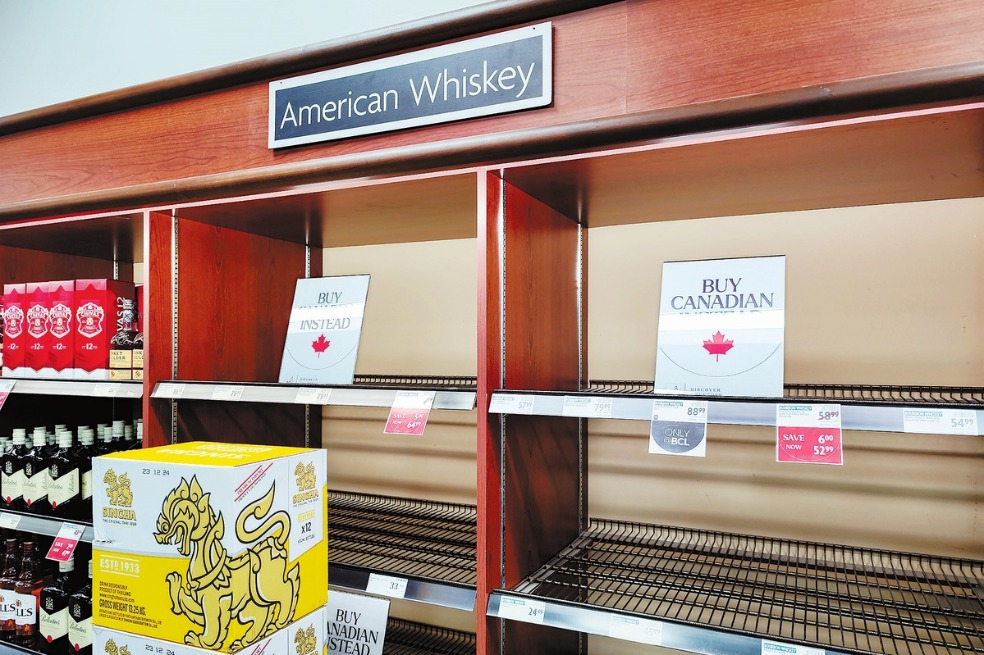

Last month, the Ontario government directed the Liquor Control Board of Ontario, or LCBO, to halt the sale and import of all US beverage alcohol, as part of its response to US tariffs on Canadian goods.

The LCBO is the importer of record for all US alcohol products into Ontario, with annual sales of up to $965 million.

"I think it's wonderful," said Peter Wilson, a 65-year-old shopper at an LCBO in Toronto, referring to the store's reduced availability of US wines. "I support that 200 percent."

Wilson, who said he would not buy US wine, linked his boycott to political dissatisfaction.

Other Canadian provinces such as British Columbia, Quebec and Nova Scotia also have imposed similar bans on US alcohol products.

"No question, the US is going to lose a bunch of Canadian shoppers," said Mark, an LCBO customer who declined to provide his last name.

Eyler said the LCBO's decision, given Ontario's population and market weight, matters in two critical ways.

"The LCBO's move shows that Canadians may reduce their purchases of American wine enough to where it makes sense to provide shelf space to other products, specifically Canadian wine," he said.

Eyler argued that for US exporters, the message is clear: Overconfidence in US market power may no longer be justified.

"It does show that uncertainty means potential market loss, and the US may not have the market power it perceives to possess," Eyler said.

The Wine Institute of California said on April 2 that wineries across the United States continue to suffer economic harm from Canada's total ban on US wine sales.

Before the restrictions, Canada accounted for 35 percent of all US wine exports, with a retail value exceeding $1.1 billion, according to the institute.

Wide impact

Robert P. Koch, president and CEO of the Wine Institute, said in a statement, "As this dispute drags on, it is creating economic instability at a time when the industry is already under significant pressure.

"When our industry is disrupted, the impact reaches far beyond the winery — affecting farmworkers, distributors, small businesses, restaurants and entire communities across the country."

Despite that, Eyler said that a pivot to alternative markets may not be an easy solution. "That is unlikely due to the cost of trying to enter other markets, the general price uncertainty with the current tariff situation, and global competition," he said.

Rather than spurring immediate trade diversification, Eyler noted that the ongoing tension could contribute to broader structural shifts within the US wine industry.

"Because exports are a relatively small part of the US market, that will probably not drive as much change as the cost of doing business rising and uncertainty around labor and consumer demand," he said.

"Expect more consolidation and less consumer choice; wine manufacturing is not part of how protectionist policies aim to repatriate manufacturing," he added.