Removing obstacles

WANG XIAOYING/CHINA DAILY

Leveraging the China-ASEAN FTA is the best way to address challenges posed by European and US tariffs, shortage in public funds and lagging infrastructure

Against the backdrop of an intensifying global climate crisis, China and the Association of Southeast Asian Nations, as major developing economies in the Asia-Pacific region, face similar environmental pressures to their development aspirations. Currently, with the alignment of China's carbon neutrality goals and ASEAN's energy transition plans, bilateral collaboration in addressing climate change is entering a new period of strategic opportunities.

As for the new energy industrial capacity, Chinese wind and solar companies have established integrated production capacities in ASEAN, making the region a critical link in the global supply chains of Chinese enterprises. For instance, in September 2023, Chinese solar panel maker Trina Solar announced an additional $400 million investment in Vietnam to build photovoltaic production lines, which are expected to commence operations by 2025.The module production capacity of Chinese PV companies totaled about 50 gigawatts by the first quarter of 2024, accounting for 53.6 percent of the region's total.

In the new energy vehicle sector, ASEAN has become a key destination for Chinese automakers' overseas investments. BYD's first overseas passenger vehicle plant, completed in Thailand in 2023 with an investment of 7 billion yuan ($964 million) and an annual production capacity of 150,000 units, mainly serves the ASEAN market. Chinese brands commanded about 67 percent of ASEAN's NEV sales in 2023.

Chinese companies are actively developing new energy projects in the ASEAN countries. Since 2024, multiple new projects have broken ground, including PowerChina's agreement with Manila Electric Company in November to develop Southeast Asia's largest PV project — with a total installed capacity of 3.5 gigawatts of solar power and 4.5 gigawatt-hours of energy storage — which is expected to reduce carbon emissions by 1.23 million metric tons annually upon completion.

Despite the steady progress, external factors such as global economic conditions and geopolitical factors are posing challenges to the advancement of China-ASEAN climate cooperation.

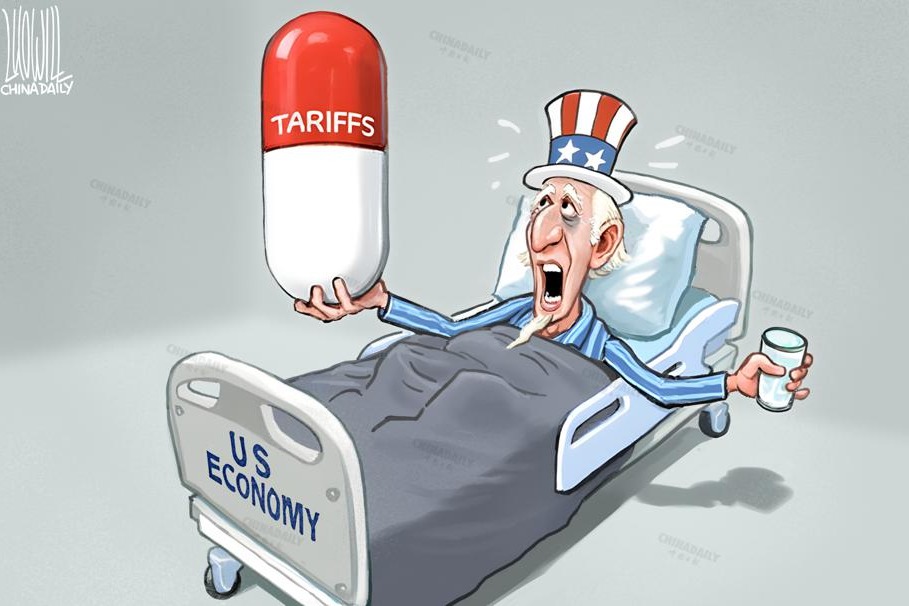

First, the new European and US tariff policies have led to the risk of overcapacity in the deployment of new energy production capacity in the region.

In 2024, the United States revoked tariff exemptions for solar modules from four Southeast Asian countries (Cambodia, Malaysia, Thailand and Vietnam), while in 2023 the European Union's new Batteries Regulation raised compliance costs for meeting carbon footprint requirements for electric vehicle batteries produced in Southeast Asia. These measures have significantly increased export costs to Western markets, forcing Southeast Asian producers to pivot to local sales. As such, ASEAN's market size will be limited and may eventually lead to the problem of overcapacity. For example, production lines of LONGi Green Energy Technology and Trina Solar have already suspended some production in the region due to sanctions.

Second, public funding shortages have become a crucial bottleneck to further bilateral climate cooperation between China and ASEAN.

According to the International Renewable Energy Agency, ASEAN requires an annual investment of $45 billion by 2030 for renewable energy and grid infrastructure to align with a 1.5 C pathway. However, from 2016 to 2020, public investment in ASEAN's energy as a whole totaled about $20 billion. This systemic funding gap has forced Chinese investors to bear higher financial risks when investing in the region. For example, PowerChina's Nam Ou cascade hydropower project in Laos — operational for 29 years with electricity payments from Laos — is grappling with $555 million in unpaid bills by Laos' state power company since 2020. Such incidents will undermine bilateral climate cooperation between China and ASEAN countries.

Third, lagging development in infrastructure has constrained returns on Chinese companies' new energy projects in ASEAN countries.

Weak energy infrastructure in ASEAN — including fragmented grids, limited high-voltage transmission lines and inadequate energy storage — has severely undermined the economic viability of renewable projects invested by Chinese companies. For instance, Vietnam's Ministry of Industry and Trade reported a 15 to 20 percent curtailment rate for solar power in 2023 due to grid constraints, resulting in less-than-satisfactory returns on Chinese solar projects.

With the substantial conclusion of Version 3.0 China-ASEAN Free Trade Area upgrade negotiations in October 2024, the two sides have taken a crucial step forward in aligning rules and standards in areas such as trade and investment liberalization, the digital economy and the green economy. The green economy, as one of the core issues in the upgrade of the free trade zone, is becoming a significant lever for deepening climate cooperation.

To deepen climate cooperation between China and ASEAN, the following measures should be considered.

To start with, in response to the challenges posed by European and US tariff policies impacting the export of new energy production capacity in Southeast Asia, China and ASEAN should restructure the competitiveness of the regional industrial chain with localization at the core to reduce costs and enhance efficiency.

The two sides should leverage FTA incentives to improve the efficiency of local raw material procurement, reduce cross-border logistics, and cut production costs. They should also invest in technical training for local workers to enhance employment and reduce labor costs, fostering a "policy-industry-employment "virtuous cycle.

Second, in light of the issue of risk-return mismatch caused by a shortage in public funds, China and ASEAN should innovate the collaborative model between resources and projects.

In particular, they should use the China-ASEAN FTA as a platform to link Chinese State-owned enterprises' renewable investments with ASEAN resource development rights.

Based on that, they should jointly promote local currency-based cross-border settlements and hedging mechanisms to reduce currency risks, lower the payment pressure of host countries and ensure sustainable investments by Chinese companies.

Last, it is imperative to strengthen cross-regional collaborative planning capabilities, given the constraints that lagging infrastructure imposes on the economic viability of projects.

Leveraging the FTA as a platform, the Chinese-led cross-regional collaborative planning should be regarded as a key point to promote the simultaneous development and coordinated layout of grid upgrades and new energy infrastructure construction. By directly matching grid expansion and energy storage facility construction with the development of new energy bases, power production facilities and power transmission facilities can be put into operation simultaneously, thus shortening the project investment return cycle and fundamentally ensuring the economic viability of the project.

The author is a chair professor at the School of Management and director of the China Institute for Studies in Energy Policy at Xiamen University. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at [email protected].