Dark-side economics loom on the horizon

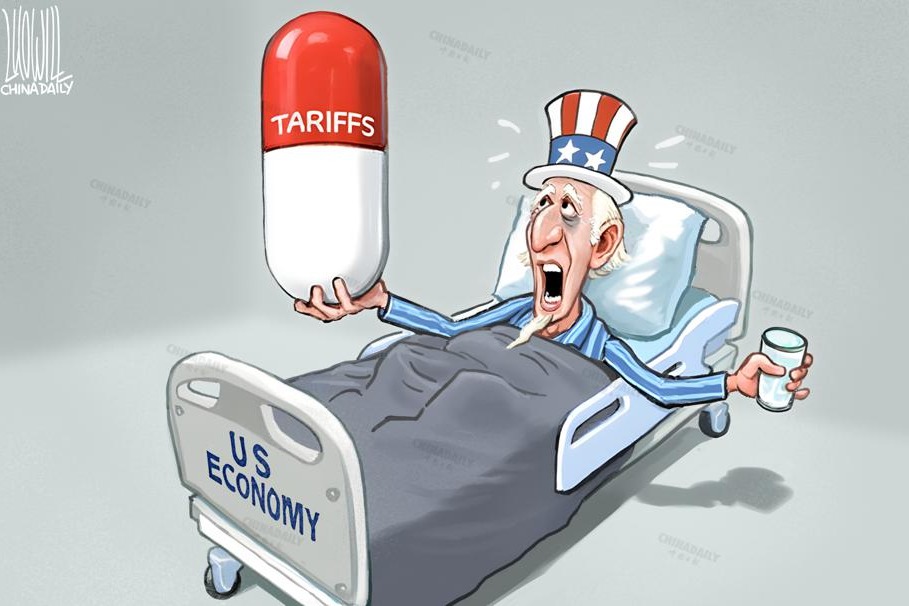

For people concerned with trade, this is the most astonishing time since World War II. The US administration's tariffs have the potential to hit trade flows harder than the terrorist security crisis of Sept 11, 2001, the financial fallout of the global financial crisis, and the freezing of supply chains during the COVID-19 pandemic. Given the huge uncertainty and the day-by-day changes to US tariffs, it is timely to recap what we know and what we do not know about this shock. This uncertainty is a result of the highly personalized decision-making that Donald Trump has brought to the presidential office, with his tendency to announce policies, then backtrack and change them.

In early April he announced an ad hoc regime of high tariffs on most of the world's production, especially focused on East Asia, announced on so-called Liberation Day. This resulted in anxiety and volatility in global equity, bond and foreign exchange markets, with considerable loss of value. US President Donald Trump then backtracked completely from the global fight, and decided instead to re-focus on a bilateral tariff war with China. China has partly reciprocated. At the time of writing, US tariffs are as high as 245 percent on some Chinese goods and China's on US imports are as high as 125 percent, together with export restrictions on certain technologies imposed by both sides. Following domestic consumer outrage, the US administration has now made some exceptions for consumer electronics.

As a discipline, economists may disagree about many things. But the vast majority agree that the US tariffs will stimulate domestic production within the US, but at the expense of increasing production costs and allocative inefficiency, thus reducing productivity and causing enduring price rises.

The magnitude of these import taxes is massive. We are used to modelling the impact of tariffs increasing by say 10 percent. But economic models are not calibrated for these huge changes. Consequently no one knows exactly what a 145 percent tax could do. But we do know that trade will reduce, inflation will increase and economic growth will be cut.

Who pays for these tariffs? The answer is that it will cost both trading partners, to a degree determined by the elasticities of supply and demand. That means that for a cellphone assembled in China for which there are few substitutes, the US must bear most of the costs; for Chinese mineral exports that only have a market in the US, China will be more impacted.

The uncertainty generated by these tariffs will particularly hurt growth. That is because their magnitude is unique and because of the likelihood of unexpected sudden changes ahead. To maximize growth the OECD emphasizes stability, predictability and independence from the political process. The tariffs contravene all these criteria.

The tariffs partly reflect past US failures to implement policies that would redistribute the gains from trade flows, for example from Silicon Valley to cushion the domestic Rust Belt employment losses. This imbalance has been building for more than a decade.

In some Western economists' eyes, the situation is also a consequence of the huge Chinese merchandise trade deficit. In hindsight, China might have seen this mounting political tension and looked for a way to diffuse it. Many in the US see China as failing to rebalance its own economy with more domestic consumption. The trade problems encountered by the Japanese in the 1980s when its efficient car production threatened US manufacturing, resulting in voluntary export restrictions, offered a lesson.

We will now see economic decoupling taking place — it will be unpredictable and at times uncomfortable, with price hikes and shortages during the transition, which may take years. Boards of directors are reviewing where to relocate, executives are struggling to operate in this new environment, purchasing managers are rerouting supply chains. This probably means the end of the trade-driven East Asian growth model, and it also means a reshuffle of production facilities throughout Southeast Asia, with a re-casting of markets by China.

It is confusing to try to unpick the rationale that lies behind these tariff decisions. A Western economy generally graduated from agriculture to manufacturing to services. For years the US has been losing manufacturing competitiveness and that has not surprised development economists. But this has been partially compensated by a thriving service sector in which most in the US work, with expertise in software, other intellectual property, branding, marketing, financial and business services, transport and tourism. US service exports are in strong surplus with most countries and this has successfully driven the strong US economy.

In the past US-China trade recorded the highest inter-country flows ever, with both economies benefiting from the efficiencies this brought. Now this has completely changed; trade will likely wind back into two separate trade blocs. The last time this happened was during the Cold War. Other countries may show trade policy leadership, many are reconsidering expanding free trade agreements which would be helpful. But at a time when we need economic leadership, better quality growth, and consensus on climate change policies, there is a risk that governments are refocusing on power policies, and may be susceptible to unhelpful bilateral deals.

There is no certainty that today's tariffs will survive beyond the next few years. But if they remain in place, the economic future looks bleak: we see a belligerent trade landscape with countries looking for "dark side economics" — tools to harm the other player. These are risky strategies and could end up being "lose-lose".

The author is chair of the New Zealand Pacific Economic Cooperation Council. The views expressed are personal ones and don't necessarily reflect those of China Daily or NZPECC or other affiliations.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].