|

BIZCHINA> Top Biz News

|

|

Equities recover in range-bound trade

(China Daily/agencies)

Updated: 2009-09-02 08:05

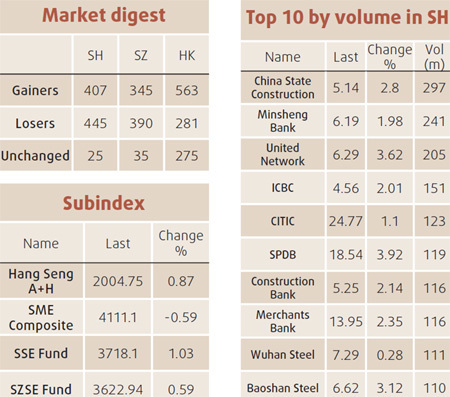

China's benchmark stock index rose yesterday, following its biggest drop since June 2008, as financial companies gained on speculation recent declines were excessive and as the country's manufacturing expanded. Bank of China Ltd added 1.9 percent, climbing from a three-month low. China Life Insurance Co advanced 4.3 percent, snapping a three-day retreat, after UBS AG raised its rating on the stock. Jiangxi Copper Co slid 4.3 percent, leading losses by commodity producers, after metal prices fell. The Shanghai Composite Index rose 15.98, or 0.6 percent, to 2,683.72 at close, after swinging between gains and losses more than 10 times. The gauge plunged 6.7 percent on Monday and entered a bear market on concern a slowdown in lending growth may derail a rebound in the world's third-largest economy. The CSI 300 Index, measuring exchanges in Shanghai and Shenzhen, gained 0.5 percent to 2,843.70.

Manufacturing expanded at the fastest pace in 16 months in August, driven by record lending in the first half of the year. The official Purchasing Managers' Index added to a seasonally adjusted 54 from 53.3 in July, the Federation of Logistics and Purchasing said. Readings above 50 indicate expansions. 'Good opportunity' "Stocks are cheap now relative to the current economic fundamentals," said Zhang Kun, strategist at Guotai Junan Securities Co. "It'll be a good opportunity to buy equities when the market stabilizes." The Shanghai gauge slumped 22 percent in August, the worst monthly performance since October, as banks reined in lending to avert asset bubbles and policy makers advised industries such as steel and cement to curb overcapacity. The decline stopped a rally that had sent the measure up 103 percent from a November low on prospects the government's 4 trillion yuan stimulus program and a record amount of new loans will ensure the economy grows at least 8 percent this year. New loans plunged to 355.9 billion yuan in July, less than a quarter of June's level, and may slump to 200 billion yuan in August, the business magazine Caijing reported on Monday without citing anyone. 'Deep bubble' The Shanghai Composite may fall another 25 percent as China's economic recovery isn't "sustainable," former Morgan Stanley Asian economist Andy Xie said. "The market is in deep bubble territory," Xie, 49, who correctly predicted in April 2007 that China's equities would tumble, said in an interview with Bloomberg Television on Monday.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 一区二三区国产 | 国产成人免费片在线视频观看 | 国产成人福利美女观看视频 | 日本免费高清视频二区 | 国产精品高清视亚洲一区二区 | 免费在线观看亚洲 | 亚洲mm8成为人影院 亚洲m男在线中文字幕 | 人成午夜 | aaa在线观看高清免费 | 成人免费福利网站在线看 | 久久久久免费精品视频 | 一级国产在线观看高清 | 一级黄色录相片 | 亚洲国产欧洲综合997久久 | 色伊人国产高清在线 | 免费观看情趣v视频网站 | 久久精品2| 97免费视频观看 | 欧美xxxxxxxxxxxxx 欧美xxxxx毛片 | 一级特黄一欧美俄罗斯毛片 | 国产一区二区在线视频 | 欧美手机手机在线视频一区 | 久久久久欧美情爱精品 | 草草视频在线免费观看 | 日本加勒比在线播放 | 久久99国产精品久久99果冻传媒 | 国产精品19禁在线观看2021 | 1024香蕉视频在线播放 | 日本三级特黄 | 日本农村寡妇一级毛片 | 国产精品深爱在线 | 精品国产香蕉伊思人在线 | 国产在线播放成人免费 | 婷婷在线成人免费观看搜索 | 国产在线步兵一区二区三区 | 欧美在线小视频 | 国产精品永久在线 | 91精品久久久久久久久久 | 亚洲一区区 | 成人综合婷婷国产精品久久免费 | 在线播放成人高清免费视频 |