Figures for outward and inward foreign direct investment are also going in opposite directions

If you look at recent figures on China's foreign direct investment you will find two opposite trends: China's outward FDI rose almost 12 fold, from $5.5 billion (4.2 billion euros) a year to more than $65 billion a year from 2004 to 2011, and it is expected to reach $150 billion by 2015. On the other hand, inward FDI fell 0.2 percent in October from a year earlier to $8.3 billion, the 11th fall in 12 months.

Based on statistics from the Ministry of Commerce, accumulated inward FDI in the first 10 months of last year fell 3.5 percent to $91.7 billion, while outward FDI rose 25.8 percent to $58.2 billion. Inward FDI is forecast to slow more sharply this year, and outward FDI will keep on growing strongly. As a result, China's outward FDI may surpass its inward FDI within one year.

Is it too early for China to become a net capital exporter at its current economic development stage? If so, should China rein in the growth of outward FDI?

Standard economic theory suggests capital should generally flow from rich countries to poor ones. China, as a developing country, is still relatively poor, with GDP of about $5,500 per capita. Japan became a net exporter of FDI in the 1980s with GDP of about $12,000 per capita, while South Korea did so in the 1990s with GDP of about $10,000 per capita. So it may be too early for China to be a net capital exporter.

Whereas inward FDI is a variable outside Chinese government control, outward FDI is not. So should China slow the growth of outward FDI? Here we need to examine two key variables: capital and exports, which have served as economic engines for China's growth over the past few decades.

First, let's analyze whether outward FDI reduces the stock of domestic capital. A number of economists have done studies that analyze the impact of outward FDI on domestic economic activities. Martin Feldstein, a scholar at the National Bureau of Economic Research in the US, analyzed decade-long averages of aggregate FDI and domestic investment in economies of the Organization for Economic Cooperation and Development, reporting evidence that outward FDI reduces domestic investment. It is argued that each country has a fixed amount of capital for a given period, so any additional outward FDI results in reduced domestic capital stock.

Other economists have reached a different conclusion in studying the bilateral flow of aggregate investment between several OECD countries, finding no evidence of outward FDI negatively affecting domestic investment. However, these studies have almost always focused on advanced OECD countries. Since developing countries have mostly been recipients of FDI, rather than exporters of it, it is little surprise that there is a paucity of studies on the subject.

Second, we need to analyze whether outward FDI substitutes for exports. The general understanding is that when factories that produce for export are moved overseas to be closer to their customers or export markets, the export volume will fall.

Bruce Blonigen at the University of Oregon looked at the question of whether foreign production by multinationals is a substitute for exports or is complementary to them, and found evidence for both. Other studies have suggested that, overall, outward FDI is good for home exports, the export-creating effect of outward FDI outweighing the export-replacing effect. Again, since the evidence regarding the effect of outward FDI on exports is mixed, and given the lack of studies that consider the case of developing countries, this question remains an open one.

Although empirical economic studies have no conclusive answers on the two key issues for developing countries in general, with China's situation it may not be too difficult for us to draw a conclusion.

China is known for its large income gap. A recent study at Harvard University shows how the outward capital movement in China's high concentration of wealth environment could lead to a massive drain on foreign reserves. The study estimates that the top 1 percent of China's wealthy families control between $2 trillion and $5 trillion of wealth. If they were to move 30-40 percent of their wealth out of the country, the study estimates, reserves could fall by at least $1 trillion, or about a third of the total. The study also points out that Japan, in contrast, has $1.3 trillion of reserves, but since income and wealth are more equitably distributed, the risk of a massive reserve drain is far lower.

The Harvard study may simply demonstrate a highly hypothetical situation, because China now maintains capital-flow controls. However, it shed light on China's recent outward-FDI figures.

Research by the British bank Barclays analyzed data on international outward FDI data from 2006 to 2008, and showed where China's outward FDI went and how the country's outward FDI profile differed from the rest of the world. This research demonstrates that most of China's outward FDI (76 percent) went into services, with just 5 percent to manufacturing and 19 percent to primary industries (mining, agriculture, and oil). In contrast, in the rest of the world 61 percent of FDI went to services, about 22 percent went to manufacturing and 15 percent went to primary industries.

It is understandable that China has a much larger share dedicated to extracting the natural resources needed to drive its booming economy. The mystery is why its outward FDI in services was so high. It is doubtful that these investments really went toward creating foreign service companies, and it is highly likely that they went toward buying foreign real estate, which could be a component of the service sector. So who was buying foreign real estate and making other deals?

Reports are legion about wealthy Chinese buying real estate on Mediterranean islands, in Europe and North America, and paying enormous fees to send their children to expensive schools there or in Singapore. According to a Wall Street Journal analysis of recent data, in the 12 months to September, $225 billion flowed out of China. That is equivalent to about 3 percent of national economic output last year.

China used to watch capital flow into the country, but now it is watching it flow out.

Harvard University's study has some merits. First, with a high income gap, what wealthy Chinese families are doing regarding outward capital movements may partly account for the high growth of recent private outward FDI from the country. It is also possible that a relatively small part of the population could precipitate a serious financial problem and cause domestic investment capital to fall if they can freely move capital funds out of the country.

Second, large-scale outward capital movement does affect China's economy. A lot of research on economic development has suggested a significant role for capital investment in economic growth, and to a great extent China's long economic growth can be attributable to capital investment.

Economic theory says that capital investment generally makes a country more productive because new machinery, newer technology and better infrastructure help raise output. An International Monetary Fund study shows that China has achieved impressive gains in productivity in recent years. Some of this is undoubtedly as a result of capital investment. When capital flows out of China, the economic system will produce the opposite effects. Reduced capital will bring productivity - and economic growth - down.

To maintain an adequate amount of capital for its domestic economic growth, China may need tighter policy on private outward FDI, especially in the current economic environment in which labor costs have risen and economic growth has fallen to a 13-year-low.

The transfer of funds overseas by individuals and businesses are nominally curbed, but often a blind eye is turned to those rules.

China should close loopholes in the system and adjust the structure of its outward FDI by reducing the amount that goes into services. It should slow the growth of outward FDI and tighten its capital outflow controls until the income gap is reduced to a reasonable level.

The author is an economics professor with the University of Maryland University College. The views do not necessarily reflect those of China Daily.

'Cat model' to dazzle Shanghai auto show 2013

'Cat model' to dazzle Shanghai auto show 2013

Models at Tokyo modified car show

Models at Tokyo modified car show

Shanghai Fashion Week focuses on domestic brands

Shanghai Fashion Week focuses on domestic brands

Angel-dress models at Shandong auto show

Angel-dress models at Shandong auto show

Safe and Sound

Safe and Sound

Theater firms scramble for managers

Theater firms scramble for managers

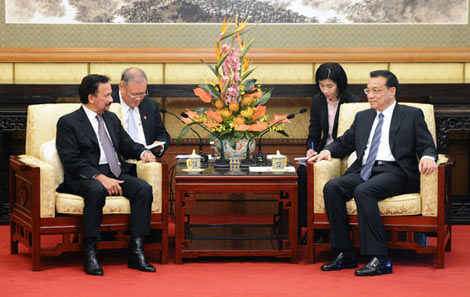

Premier pledges closer ties with Brunei

Premier pledges closer ties with Brunei

Volkswagen's all-new GTI at New York auto show

Volkswagen's all-new GTI at New York auto show