The Shanghai Shipping Freight Exchange Co will launch the world's first derivatives for shipping capacity delivery on Thursday in a bid to meet increasing demand for hedging tools.

Analysts said that the contracts will provide better insight into domestic shipping rates, as well as giving China a larger voice in pricing and more experience in developing financial products for the shipping industry.

The contracts will be based on coal shipping rates from Qinhuangdao, in North China's Hebei province, to Shanghai along north-to-south shipping routes.

The exchange will initially offer 12 contracts, ranging from January 2014 to December 2014. The initial trading margin is 10 percent of contract value, rising to 30 percent in the delivery month.

The SSFEC has also introduced derivatives for coastal coal shipping rates with cash delivery. The new derivatives that are launching on Thursday will be for spot delivery, which will enable vessel owners and cargo shippers to complete delivery after the contracts mature.

"Given the current excess capacity in the shipping industry, carriers can use the derivatives trading platform as a new sales channel," said Wu Di, the deputy head of the SSFEC.

China's annual coal output has surpassed 3.6 billion metric tons, the world's largest. More than 650 million metric tons of coal are shipped from north to south in China every year, according to National Bureau of Statistics data.

"Coal shipping rates affect not only the shipping industry but also the power, construction and metal sectors," said Wu.

The shipping industry has always been exposed to rate volatility, and many factors - including global economic activity, domestic economic growth, trade and climate change - may affect the industry's health, said Wang Dongsheng, an analyst with Shanghai Wanyuan Investment Co Ltd.

"Shipping price indexes are also signals of economic growth and exports, and tracking the index can help enterprises take proactive measures amid a fast-changing market," said Wang.

Since the first shipping price index was introduced in London in 1985, shipping price derivatives have been widely accepted and traded in global shipping markets, with annual trading volumes of more than $100 billion, according to the SSFEC.

"It is necessary to accelerate the development of shipping price index derivatives trading," according to the general plan for the new China (Shanghai) Pilot Free Trade Zone.

Shanghai aims to become an international shipping center, and developing derivatives for shippers has become a major task of the SSFEC, the exchange said.

China's shipping industry and financial services for shipping companies are facing increasingly fierce global competition.

In September, the London-based Baltic Exchange set up its first office in China in 270 years in Shanghai's Pudong district. The exchange's freight index is widely used in the global shipping industry.

"China's shipping industry accounts for 60 percent of the global total and Shanghai is the world's largest port. We welcome competition from all over the world," said Wu.

Wu said that the SSFEC will introduce derivatives for international dry bulk carrier rates and it will also improve current derivatives for container rates.

Beijing suburb to hold 2014 APEC meeting

Beijing suburb to hold 2014 APEC meeting

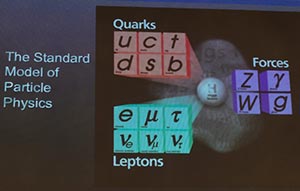

Belgian, British scientists share 2013 Nobel Prize in Physics

Belgian, British scientists share 2013 Nobel Prize in Physics

Model with modified BMW X6 M SUV

Model with modified BMW X6 M SUV

'Golden Week': No pain, no gain

'Golden Week': No pain, no gain

Car firms shifting focus

Car firms shifting focus

A slice of paradise lures tourists

A slice of paradise lures tourists

Tibet expected to witness bumper harvest

Tibet expected to witness bumper harvest

Shanghai inaugurates Free Trade Zone

Shanghai inaugurates Free Trade Zone