The People's Bank of China provided standing lending facility (SLF) of 100 billion yuan ($16.28 billion) each with a three-month tenor to China's five biggest banks (Industrial and Commercial Bank of China, Agricultural Bank of China, China Construction Bank, Bank of China and Bank of Communications) this week.

The PBOC (or China's central bank) introduced the SLF in early 2013 as an additional means to provide liquidity to specific institutions (mostly policy banks and national commercial banks), typically with a tenor of one to three months.

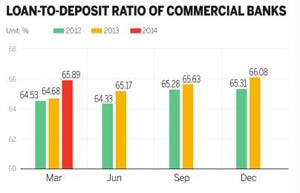

In size, this operation would be roughly equivalent to a 45 basis point reserve requirement rate (RRR) cut for all banks. It increases the money base. If not constrained by caps on loan-to-deposit (LTD) ratios or other administrative regulation, it would increase the banks' ability to extend credit. But several of the large banks will be at least in part constrained in their lending by the current maximum LTD ratios applied to them.

The impact on financial conditions and the economy will also be limited by the fact that, unlike a RRR cut, the facility only lasts three months. The central bank may decide to roll it over. But since that is not certain, the banks will not count on it in their decisions.

Thus, while the step will ease financial conditions, the impact is likely to be modest. In line with this, inter-bank interest rates on Wednesday morning edged down somewhat.

Following so quickly on the bad August data, this move signals policymakers' intention to take measures to shore up growth so as not to miss the 7.5 percent GDP growth target for this year by too much.

Is it a harbinger of more general, more significant measures to come or, on the contrary, does it reduce the chance of bolder measures such as a generalized cut in the RRR or interest rates? In our (Royal Bank of Scotland) view, this measure reduces the chance of other, bigger steps in the monetary sphere in the very short term. We think it is more likely to see measures such as supporting the infrastructure sector and the property market.

Looking a little further ahead, though, if downward pressures on growth persist, we would expect more general and higher profile measures, including possibly a general cut in reserve requirement rates or lending interest rates.

Earlier this year, the central bank took several "targeted easing measures'. Why? It seems the central bank does not want to be seen as providing general, high profile stimulus in conformity of the senior leadership calling for reform over stimulus and the need to rein in financial risks.

The problem is that the use of such targeted, specific instruments runs counter to the envisaged reform of monetary policy. That reform is supposed to be making monetary policy more indirect, market based. However, several of the measures and new instruments introduced this year move monetary policy in the opposite direction, making it more direct and less market oriented.

The authors are economists with the Royal Bank of Scotland.

|

|

| PBOC acts to shore up liquidity | Starting now, bank loans easier to get |