The transition from traditional financial services to Internet-based alternatives has become "a new norm" of the Chinese economy, according to market insiders.

Different types of online financial businesses have expanded rapidly over the past year.

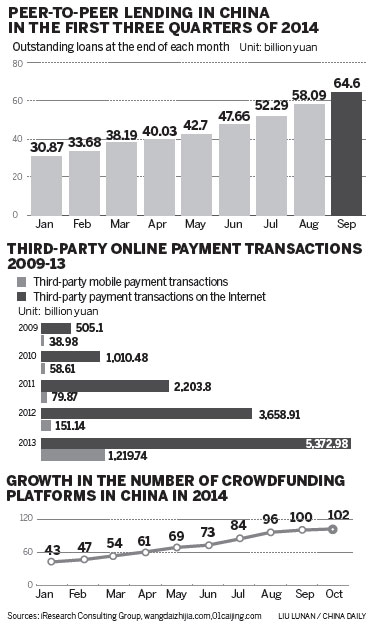

In September, the number of peer-to-peer lending companies increased to 1,438, with outstanding loans hitting 64.6 billion yuan ($10.6 billion), up 11 percent month-on-month.

The outstanding loans are expected to reach 90 billion yuan by the end of this year, according to data from wangdaizhijia.com, a Web portal that tracks the industry.

The popularity of crowd-funding and online payments is also on the rise. As of Sept 30, China had at least 100 crowd-funding platforms, and the nine leading project-oriented platforms had raised 292.15 billion yuan for 327 projects.

According to iResearch Consulting Group, a market research firm focusing on China's Internet industry, third-party payment transactions on the Web amounted to 5.37 trillion yuan in 2013, up 46.8 percent from the previous year. Meanwhile, third-party mobile payment transactions increased by 707 percent year-on-year to 1.22 trillion yuan.

The number of Web users in China had reached 632 million by the end of June, while the number of cellphone users climbed to 527 million.

Experts say Internet finance companies can meet the demand from low-end clients for investment and financial management services by making innovations in financial services, marketing channels and business models. This may help to alleviate the difficulties faced by small businesses as they try to obtain loans and reduce their financing costs.

Zeng Yuhui, chief executive of Credit Finance, a peer-to-peer (also known as P2P) lending platform in Shenzhen, Guangdong province, said annualized interest rates for private lending are usually 30 to 40 percent in China, and sometimes reach 50 to 60 percent.

However, a P2P lending platform can cut a small company's annualized financing costs in the medium and short terms to less than 20 percent.

Some P2P lenders have not yet developed standardized operations due to the lack of regulation. Improvements and innovations should be implemented to promote the healthy development of the industry, Zeng said.

He urged the banking regulator to encourage P2P lending platforms to use banks, rather than third-party payment companies, to look after funds because banks have more stringent supervisory processes.

Most P2P lending companies conduct online and offline inquiries into borrowers' credit ratings and ability to repay debt, as well as their reasons for borrowing money. Future improvements to national credit assessment methods would reduce the companies' manpower costs, which are significantly increased by the need for offline investigations.

"We look forward to the central bank opening its credit information system to P2P lending companies," Zeng said. "We hope that some commercial enterprises that are actively building their own databases of credit-related information will allow us to have access to their data."

Bank executives are facing growing competition from Internet finance companies, and as a result are changing their traditional mindset and adopting strategies to develop online and mobile services.

Shao Ping, the president of Ping An Bank, a joint-stock commercial bank based in Shenzhen, Guangdong province, said Chinese banks are shifting from product-orientation to customer-orientation.

As well as reaching out to low-net-worth clients, they are also using large-scale data mining and cloud computing technologies to improve risk management.

The bank launched a cloud-based e-commerce platform for small and medium-sized enterprises in 2014. During the first half of this year, the platform attracted 6,162 new clients and achieved noninterest net income of 622 million yuan. The bank's net profit rose by 34 percent to 15.69 billion yuan in the first three quarters compared with the same period last year.

In a research report published in June, Singapore-based DBS Bank said the new age of digital technology is set to revolutionize the way businesses operate.

The bank announced in January that it will introduce IBM's Watson, an innovative computer system, in its wealth-management business to enhance the customer experience by quickly analyzing, understanding and responding to data.

Piyush Gupta, chief executive of DBS, said earlier this year: "In the future, people are not going to need banks. People need banking. The ability to integrate banking into the day-to-day life of customers is what's going to distinguish and redefine banks of the future and banking of the future."

|

|

| Online banking on the rise | Investors shunning property for funds |

?