Insurers' premium growth set to slow

The premium growth of insurers is set to slow this year after the explosive rise in 2016, as financial deleveraging and a more restrictive regulatory approach to curb risks will be a priority for regulators, an insurance official said on Tuesday.

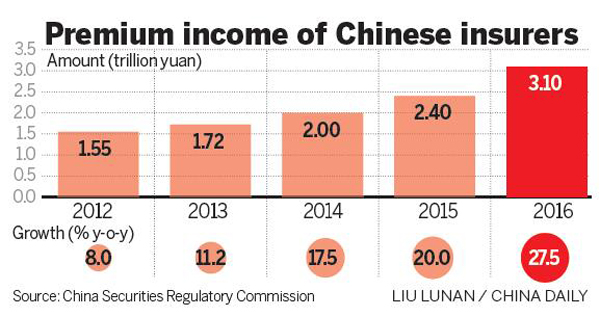

Total insurance premiums reached 3.1 trillion yuan ($452 billion) last year, up by 27.5 percent from the previous year, according to data from the China Insurance Regulatory Commission.

"The growth will get slower this year as deleveraging will be a main theme and regulation will be tighter," Duan Haizhou, a statistics official with the CIRC, said at a news conference.

Profit and investment returns of Chinese insurers suffered a decline last year due to the persistent low interest rate environment, higher volatility in the equities market and rising costs.

The total profits of Chinese insurers were about 200 billion yuan last year, down 33 percent year-on-year, according to the regulator.

"The decline of investment returns is a major reason for the profit drop while rising operating costs for insurers is another reason," Duan said.

The rate of investment returns by insurance funds was 5.66 percent last year, down from 7.56 percent in 2015. The volatility of the stock market resulted in a decline of about 200 billion yuan in equity investment gains, according to Duan.

Analysts said that the trend of slowing premium growth will occur this year while investment returns may slightly improve after a substantial drop last year.

"But uncertainty still remains and the lack of good quality assets in a low rate environment will mean that insurers will continue to invest in riskier assets including stocks," said Jiao Wenchao, an analyst with Ping An Securities Co.

Chen Wenhui, vice-chairman of the CIRC, pledged at a recent industry meeting that the regulator will "firmly hold the bottom line of curbing risks" this year, indicating a more restrictive approach on aggressive equity investment by some insurers.

Riskier investments, which include equities and "other investments", accounted for 49 percent of Chinese life insurers' invested assets as of November, up from 27 percent at the end of 2013, according to a report by rating agency Moody's Investors Service Inc.