Easy credit bolsters startups, supply firms

In recent months, branch directors, account managers and 600 staff of China Minsheng Bank in Ningbo, a port city in Zhejiang province, have been stepping out of their offices and customer-facing counters to visit hundreds of enterprises. Their goal has been to conduct on-site evaluations and get first-hand understanding of clients' demands.

"Only in this way can we understand how to develop customized services and products for real economy players," said Zhao Shuqing, one of the bank's executives who visited the enterprises.

"Many companies in the city are involved in manufacturing and trade. Some need loans, some need supply chain financing services to increase turnover, and some smaller ones may not know what they need during their first days of operation. During our visits to clients, we get to understand their pain points," he said.

This kind of outreach is just one of the several measures that banks in Ningbo take to deliver customized services to sectors that strengthen the real economy.

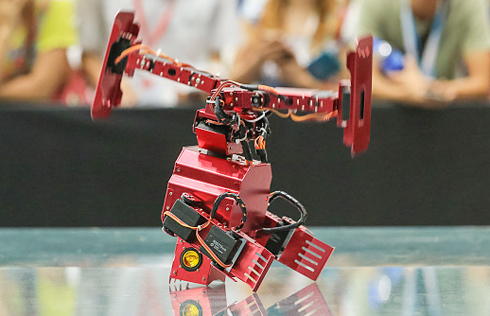

For instance, Ningbo Xiangyu Drone Technology Co Ltd, a drone developer that serves segments like environment protection and educational services, received loans from Huaxia Bank by pledging not physical assets but intellectual property as collateral.

Similarly, Zhuang Weili, founder of Weili Farm in Hangzhou, Zhejiang province, a startup that sells local fruit through e-commerce platforms, received a loan of 80,000 yuan ($12,160) by pledging patents. The firm has patents in packaging technologies that help retain freshness of perishables and in fruit-sorting processes.

"In the past, startups were less likely to get loans because banks would think they don't have enough collateral to pledge; but without credit, a small company could hardly grow. When banks reach out to us borrowers, and are willing to hear and understand us, it feels good. Best of all, their financing is prompt and helpful," said Zhuang.

A note from the bank explains the purpose of developing a new credit model for startups. "The rationale behind enabling startups to have easier access to credit is to go back to the (banking) fundamentals and the actual purpose of financing industry-to empower clients and to help them to realize bigger dreams.

"It takes more time and efforts for due diligence and research to understand how these 'new technology companies' work. Ignoring their demands would be lazy and irresponsible."

Supply chain financing services also help trading firms to increase turnover and better manage debit-credit operations.

Wang Tao, a wine dealer in Guiyang, Guizhou province, used to worry about the risks in shipping products first and receiving payments some months later.

"In our business, it's common that we receive payments months after shipment; sometimes it could be six months later. Without strong cash-flow management, you could face really tight liquidity," he said.

Three banks visited him earlier this month to see how they could help his business. He chose the one that offered him not only supply chain financing solutions but trained him in how to use cash-flow management software.

"I think banks are really thinking about how they could be helpful. Lending is important, but teaching clients how to manage money is also important. If we can't manage cash-flow well, we end up not being profitable, and banks might be exposed to risks of non-performing loans," he said.

New wealth management products are also strengthening real economy players.

According to the latest half-yearly report on China's wealth management products, compiled by the China Banking Wealth Management Registration System, about 21 trillion yuan, or 73 percent of all wealth management assets, were invested in real economy sectors through wealth management programs in the first half of 2017, up 6.5 percent year-on-year.

- Warning for investors - cheap credit may soon be over

- Chinese online small consumer credit provider Qudian debuts on NYSE

- Credit assignment contract dispute between Heilongjiang Construction Group Co, Ltd, Heilongjiang Province Construction Group Co, Ltd, Gao Yingcan, Shenzhen-based Xinnuo Telecommunication Co, Ltd, Shenzhen-based Liyumen Investment Development Co, Ltd and Harbin Hit Group Co, Ltd

- Credit rating cut a reckless move

- Investors shrug off S&P's China credit downgrade, have faith in China's growth