RMB's unstoppable climb to the global stage Mainland economy's opening-up, new stock connect help lift the yuan

Updated: 2016-09-09 07:02

By Duan Ting in Hong Kong(HK Edition)

|

|||||||||

Experts say Chinese currency's depreciaction won't hurt it going global in the short term. For the long term, the Belt and Road Initiative is expected to propel the yuan's popularity as a funding currency.

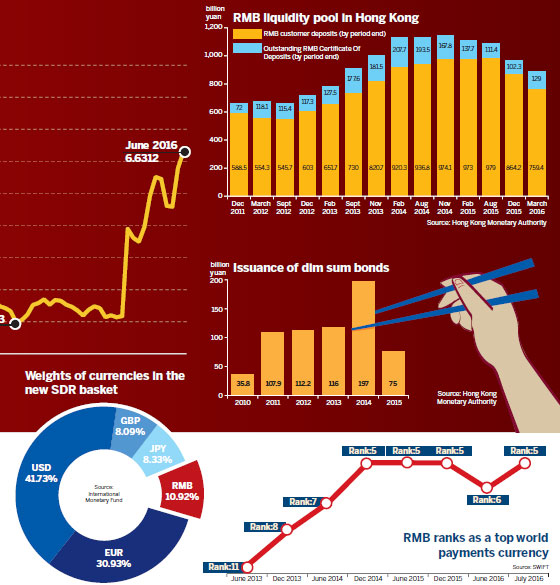

The much-anticipated Shenzhen-Hong Kong Stock Connect was approved by regulators on Aug 16 - taking the internationalization of the renminbi (RMB) another step forward ahead of the International Monetary Fund's (IMF) inclusion of RMB next month to calculate the value of Special Drawing Rights (SDRs) that were created in 1969 as a supplement to the existing reserves of member economies.

Despite the Chinese mainland currency's sharp depreciation since Aug 11 last year, experts are upbeat about its internationalization in the long term, and believe that Hong Kong will remain the most important offshore RMB center.

According to global financial messaging services provider SWIFT's (Society for Worldwide Interbank Financial Telecommunication) August 2016 RMB Tracker, the RMB rose to the No 5 spot in July this year as a world payments currency by value after having dropped to sixth position the previous month. Despite a recent slowdown, renminbi internationalization is continuing on most accounts, such as payments, bank adoption and offshore clearing center growth.

Catching up in cross-border payment

The Chinese currency continues to be the second most-used currency for cross-border payments with the mainland and Hong Kong, with a weight of 12.7 percent. The US dollar continues to be the leading currency for cross-border payments with the mainland and Hong Kong, with a share of 63.6 percent.

Fielding Chen Shiyuan, an economist at Bloomberg Intelligence, explained that, in the past few years, RMB internationalization has mainly been promoted by the People's Bank of China (PBOC). The yuan's appreciation and relatively high interest rates have lured overseas investors to hold on to the currency. On the other hand, the relatively low offshore RMB interest rates have improved the dynamic development of dim sum bonds and offshore RMB loans, as well as derivative products.

However, Chen said the two-way fluctuation and the PBOC's cutting of interest rates, which reduces the advantages of the currency, will slow down the pace of RMB internationalization.

According to Cheng Shi, head of research at ICBC International Research, the gradual opening-up of the Chinese economy and financial markets offers strong support for RMB internationalization in the long term. Especially after Britain's decision to quit the European Union, the global economic pattern has been changing, making the US and mainland economies stand out and lifting the importance of the yuan. Hong Kong's offshore RMB center status has become even more critical after Brexit.

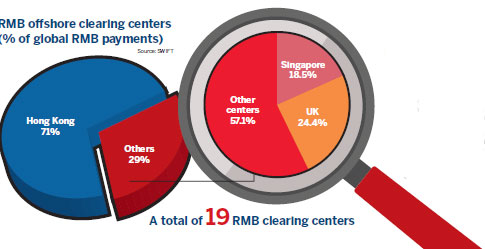

Since September 2015, three new clearing centers have been selected by the PBOC - Zambia, Argentina and Switzerland - making a total of 19 RMB clearing centers spread across the globe.

HK still the largest offshore RMB hub

However, when it comes to handling global payments in yuan, Hong Kong remains the world's largest offshore RMB center, processing 71 percent of RMB payments. The UK conducts 24.4 percent of all offshore RMB payments and had overtaken Singapore last year as the No 1 offshore RMB clearing center, excluding Hong Kong.

Chen reckoned that the other RMB centers cannot beat Hong Kong as the most important offshore RMB center for the time being. But, in future, distinctive centers elsewhere could pose a threat to Hong Kong.

He added that, based on the market infrastructure in the past years, RMB internationalization should also further serve the real economy and provide financing support to investment, trade and other business cooperation in the Belt and Road (B&R) strategy.

According to Zhang Shiyuan, chief analyst at the research and development center of Southwest Securities, the Asian Infrastructure Investment Bank, the Goldman Sachs BRIC Fund, as well as the Silk Road Fund, may take the lion's share of the work in getting offshore RMB to offer better support for the B&R Initiative.

Cheng further pointed out that Hong Kong remains the "super-connector" in the strategic project.

tingduan@chinadailyhk.com

(HK Edition 09/09/2016 page1)