Big boost for yuan ahead of SDR entry

Updated: 2016-09-15 08:01

By Bloomberg in Hong Kong(HK Edition)

|

|||||||||

|

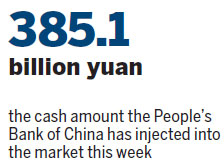

Pedestrians walk past the People's Bank of China headquarters in Beijing. The central bank has pumped 385.1 billion yuan into the market this week. Qilai Shen / Bloomberg |

Central bank's cash injections hit 5-month high in bid to keep Chinese currency stable and curb speculation

China's central bank has boosted its cash injections to a five-month high, fueling speculation that it's looking to steady the nation's financial markets.

The People's Bank of China (PBoC) pumped in a net 385.1 billion yuan ($57.7 billion) this week - the biggest additions since April - as the overnight money-market rate climbed before a series of holidays. The yuan advanced in both the onshore and overseas markets amid bets that policy makers are propping up the currency before it enters the International Monetary Fund's special drawing rights (SDR) reserves on Oct 1.

The Chinese mainland's financial markets are closed on Thursday and Friday for the traditional Mid-Autumn Festival and for the week through Oct 7 for the National Day holiday break.

Signs that the authorities are in the market have been bolstered this week, with State-run lenders seen selling dollars and the one-week offshore yuan loan rate spiking to the highest since January. The PBoC set the currency's daily fixing, which limits onshore moves to 2 percent on either side, at a level stronger than expected on Wednesday, according to HSBC Holdings.

The yuan has come under increased pressure because of the chances of a Federal Reserve interest-rate increase this year. The US central bank meets next week.

"If the tightness persists, the central bank will continue to boost cash supply through open-market operations," said Chen Peng, a Shenzhen-based analyst at Fortune Securities Co. "By using different terms of contracts, it can ensure liquidity demand for various terms was met."

The cost of borrowing yuan in Hong Kong surged the most in eight months amid speculation the PBoC is intervening to discourage bearish bets on the currency. The overnight Hong Kong Interbank Offered Rate (Hibor) climbed 5.32 percentage points to 8.16 percent, according to Treasury Markets Association data. The one-week rate rose 5.23 percentage points to 10.15 percent - the highest since January.

"The yuan Hibor was high partly because of seasonal demand and partly because the Hong Kong Monetary Authority doesn't appear too keen on providing liquidity," said Andy Ji, a Singapore-based currency strategist at Commonwealth Bank of Australia.

"Also, with the offshore yuan trading precariously close to 6.70 ahead of the upcoming holidays, the PBoC doesn't mind seeing short-end rates higher to deter speculators. It is all preempting the holidays and the Fed decision next week. If the Fed holds as expected and the dollar is softer, the offshore yuan rates will quickly come off," Ji said.

The offshore yuan advanced 0.2 percent to 6.6752 a dollar as of 4:08 pm in Hong Kong on Wednesday, while the onshore yuan strengthened 0.1 percent. The one-day repo rate was little changed at 2.15 percent in Shanghai, according to a weighted average, after rising to an almost seven-month high of 2.17 percent before Wednesday's open-market operations.

The PBoC resumed the use of 14- and 28-day reverse-repurchase agreements in the past month, with the monetary authority saying its short-term goal is to slow rising leverage. The central bank auctioned 65 billion yuan of 28-day reverse repos, 30 billion yuan of 14-day contracts and 70 billion yuan of one-week agreements on Wednesday.

China has shown a renewed focus on curbing financial risks lately, with a slew of proposals to tighten rules on wealth-management products, restructuring of listed firms and leverage in the bond market.

The nation should take steps to restrain bubble-like expansion in housing markets and tame excessive financial inflows into property, Ma Jun, chief economist of the PBoC's research bureau, told China Business News.

"There were signs recently that the PBoC is trying to guard the 6.70 level for the yuan," said Kenix Lai, a Hong Kong-based foreign-exchange analyst at Bank of East Asia Ltd. "Given the yuan's official entry into the reserve basket in October, China's central bank may not want to see too much of a decline in the yuan."

(HK Edition 09/15/2016 page6)