London as bridge is gaining ground

Ties to global markets growing partly due to expansion

The expansion of Chinese banks in London is playing an increasingly integral part in helping the city stay connected with global markets, according to Fiona Woolf, lord mayor of the Square Mile, the financial district comprising what once was the old walled city built by the Romans.

Since Woolf began her one-year appointment in November, China Construction Bank has became London's renminbi clearing bank and Industrial and Commercial Bank of China has become the first Chinese bank to receive a branch license after years of lobbying.

London's renminbi activities have taken off fast. In addition to growing renminbi deposits and investments in the city, the International Finance Corp has issued the first green renminbi bond in London. A green bond is issued for environmentally friendly projects. Also, the British government became the first non-China sovereign to issue a renminbi bond.

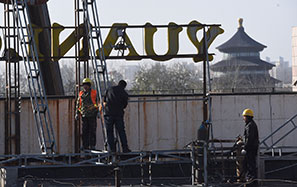

Woolf, who led a delegation to visit Beijing, Shanghai and Shenzhen on Oct 9-15, is excited by these recent achievements but says there is tremendous potential for further China-UK collaboration in financial services.

"When I was in Beijing, there was a lot of open talk on liberalization and opening up of China's financial services," Woolf says, sitting in her spacious office in the heart of the Square Mile.

"Chinese regulators were saying that they want to take steps toward more foreign participation in the financial services sector. They were looking at the Shanghai Free Trade Zone not as something unique to Shanghai but as a test-bed for liberalization that will be rolled out across China," Woolf says.

These transformations in China's quickly maturing financial services industry have also facilitated the external expansion of Chinese banks, insurance companies and other financial services companies in London.

One major breakthrough was the September granting of the branch license to ICBC, which became the first Chinese bank so awarded since regulatory changes, following the financial crisis, that restricted foreign banks' UK expansion to subsidiaries only.

Whereas subsidiaries are subject to strict capital requirements that apply to local banks in the UK, branches are seen as overseas arms of foreign banks and thus have lending and financing capacity proportional to the parent company's balance sheet.

The issue of Chinese banks wanting to set up branches first emerged in 2012 when a group of Chinese banks expressed frustration over regulatory issues in a letter that was sent by the Association of Foreign Banks to the UK Treasury.

The concerns expressed by the Chinese lenders caught the attention of the British government, and the lenders were backed by the London government.

Last year, the Bank of England said foreign banks would be allowed to apply for a branch license, although only for wholesale business.

Woolf says the granting of ICBC's branch is great news, and that she hopes many more Chinese banks will follow, so they can finance investment in the UK and globally through London.

"We are hoping that other Chinese banks will have the same aspirations because we'd love to see them as active players. They can also help fuel the growth of bilateral trade and investment between us," Woolf says.

In addition, Woolf says the increasing financial capacity of Chinese banks means they can also finance Chinese investment in opportunities globally, including in Europe, Africa and the Middle East.

In comparison with financing arranged from China itself, London's time zone may have an advantage in connecting with other global markets, and the current amount of London-based activities financing global investments is testimony to the city's capability to accommodate such trends, she says.

Besides, the city's concentration of capital and investors, as well as its cluster of financial professionals including lawyers, accountants and consultants, all makes it logical to finance deals through London, she says.

"I once met a French man at a private equity lunch, and I said to him, why are you coming to London when Paris is just two and half hours away? He said, 'I'm always within walking distance of 20 investors' (here)," Woolf says, to demonstrate her point.

Meanwhile, Woolf also expects Chinese banks in London to play another significant role, which is to facilitate the expansion of Chinese investment in London's infrastructure and energy sectors.

Having practiced as an energy lawyer and been at the cutting edge of all the major reforms in the electricity sector for over 20 years before becoming the lord mayor, Woolf is an authority on the subject of energy, and she is excited when looking at the potential Chinese investment in the UK energy sector.

Currently, Chinese investors are expected to participate in the construction of the UK's Hinkley Point C power plant, in partnership with EDF Group of France. The proposed project would cost 14 billion pounds ($2.28 billion; 1.83 billion euros), and is due to start operating in 2023 if built on time, operating for 35 years.

China General Nuclear Power Group and China National Nuclear Corporation are expected to have a combined 30 to 40 percent stake in the consortium, with French multinational energy group Areva taking another 10 percent. Exact plans are still to be announced by the investors.

Woolf says the Chinese investors have a lot to contribute to the nuclear project. "They are not just bringing capital, but expertise," Woolf says, explaining that that relates to selecting the best technology available, and understanding the operations and maintenance of the plant.

Chinese investors also can potentially contribute to the UK's railway construction, she says. Woolf says her recent experience traveling by high-speed rail from Beijing to Shanghai helped convince her that Chinese railway companies have a lot of expertise to share.

Known as High Speed 2, the British high-speed railway is planned to link London with the English Midlands and cities in North England. Construction of phase one of the project is set to begin in 2017 with an anticipated opening date of 2026.

China and the UK can also work together more closely in sustainable urban development, an issue of great importance to both, she says.

During her time in Beijing, Woolf spoke with representatives from the People's Bank of China on the topic of green finance.

She remembers that when she visited China in 2011 as sheriff of the City of London on a business trip accompanying the then lord mayor Michael Bear, China had just started to move climate change up on its agenda.

"They were asking the lord mayor how we got started with our emissions trading schemes and whether you have to make them mandatory," says Woolf, acknowledging that today's conversation is more about two-way information sharing with China having developing seven pilot carbon markets since 2011.

She says she believes it would be a great catalyst for further China-UK green finance initiatives if a Chinese government issued a renminbi green bond in London.

That would also be a big endorsement for London's capability as a key offshore renminbi center. It would make financial sense given that London's renminbi liquidity makes renminbi bond issuance easy and cost-effective, she says.

"It will be a fantastic signal to London and the rest of the world that the Chinese government is taking the green agenda seriously. It could also unlock the potential for cities that struggle to raise finance from national governments," she says.

Green bonds are a rather recent phenomenon globally, and most are denominated in the dollar or euro.

Woolf, who was born and raised in Scotland, studied law and psychology at Keele University followed by a master's degree at the University of Strasbourg in comparative law. Woolf has had a successful career as a lawyer, and when she became the 686th lord mayor of London, she was the second woman to hold the office.

Woolf says it has been a great opportunity to put diversity and inclusion in the forefront of the lord mayor's agenda, and to push organizations to welcome everyone.

|

Fiona Woolf, lord mayor of London's Square Mile, says she hopes more Chinese banks can finance investment in the UK and globally through London. Cecily Liu / China Daily |