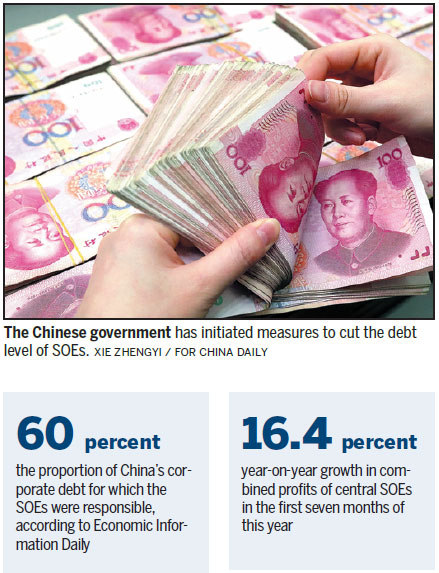

BEIJING - The Chinese government has stepped up a crackdown on State-owned enterprises debt to prevent systemic financial risks infecting the broader economy. A recent State Council meeting agreed the work would be a priority in the ongoing campaign to bring down debt levels of SOEs administered by the central government, amid improving corporate performance.

Central SOEs have made headway in cutting outdated capacity, reining in debt risks and improving competitiveness. Given the favorable conditions, more effort is needed to cut the debt level of SOEs and a guideline will be formulated, according to the meeting.

China's non-financial SOEs have a high rate of leverage. Data from the Chinese Academy of Social Sciences showed that the leverage ratios of financial institutions and non-financial institutions were 21 percent and 156 percent respectively at the end of 2015. The Economic Information Daily reported earlier that SOEs were responsible for about 60 percent of China's corporate debt.

At the recent National Financial Work Conference, the central government said deleveraging at SOEs was of utmost importance and required that SOEs give priority to deleveraging and speed up the phasing out of debt-laden "zombie enterprises."

To reduce the leverage ratio, the State-owned Assets Supervision and Administration Commission, or SASAC, has encouraged enterprises to optimize capital structure via public offerings on the stock market, and supported efforts in asset securitization, said Shen Ying, SASAC chief accountant.

As an important means to reduce SOE leverage, debt-to-equity swaps have been accelerated, allowing companies with long-term potential to exchange their debt for stocks. By the end of June, 12 central SOEs had signed debt-to-equity swaps agreements, she added.

Dong Ximiao, a senior researcher with the Chongyang Institute for Financial Studies of Renmin University of China, said that currently debt-to-equity swaps had mainly been introduced in sectors such as coal, iron and steel manufacturing.

They should expand to more heavily-indebted industries and real economy sectors with competitive product and good market prospects, he said.

According to the State Council meeting, debt-to-equity swaps will be pushed forward, with State investment funds encouraged to participate in the process. Central SOEs should speed up the pace of mergers and acquisitions.

Dong Ximiao said mergers and acquisitions were important ways to rein in SOE debt, and should go hand in hand with efforts in cutting outdated capacity.

Wu Qi, a researcher with the Chinese Academy of Sciences, said a breakthrough should be made in sectors with overcapacity, and that technological innovation should play a role in deleveraging as it helped improve corporate strength.

Combined profits of central SOEs rallied 16.4 percent year on year in the first seven months, in contrast with a 3.7 percent drop in the same period of 2016.

The debt-to-asset ratio edged down 0.2 percentage points from the beginning of the year. China's GDP expanded by 6.9 percent in the second quarter, flat from the first quarter but beating market expectations.

Xinhua