LUCIO BLANCO PITLO III

(China Daily) Updated: 2015-09-24 07:36

|

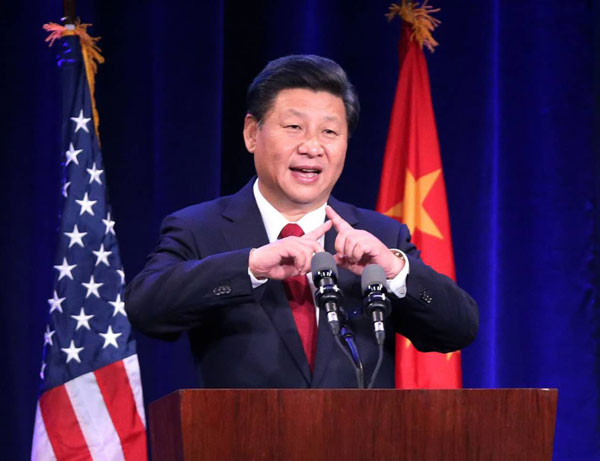

| Chinese President Xi Jinping delivers a speech during a welcome banquet jointly hosted by Washington State government and friendly communities in Seattle, the United States, Sept. 22, 2015.[Photo/Xinhua] |

As the world's two largest economies continue discussing a "Bilateral Investment Treaty", which could be a key issue during President Xi Jinping's state visit to the US, it is worth considering how national security considerations could impact the entry of foreign investment.

As the economic and political interests of the US and China continue to grow, so do their national security concerns. The evolution of their legal frameworks on foreign investments and review of the same on grounds of national security reflect this. The 2007 US' Foreign Investment and National Security Act has salient national security review (NSR) provisions. China's 2015 draft of a foreign investment law (FIL) has the same provisions.

The FINSA amended relevant provisions of Sec 721 of the US Defense Production Act of 1950 to enhance national security review. It inserted new definitions such as "covered transactions", "foreign government-controlled transaction", and "national security", as well as "critical infrastructure" and "critical technology" investments-all areas subject to national security review.

It also established the Committee on Foreign Investment in the United States, an inter-agency body headed by the secretary of treasury, which undertakes the review. The FINSA laid out the review and investigation process, the considerations for review, and the mitigation and monitoring of the threat to national security posed by the covered transaction. Finally, it also outlined actions that the president can undertake in relation to NSR, as well as the increased oversight role given to Congress.

Chapter 4 of China's draft FIL deals with national security review of foreign investments. It establishes a "Joint Conference" composed of reform and development authorities and foreign investment regulatory authorities under the State Council, China's Cabinet, which would undertake such review.

The draft FIL does not give a definition of "national security", but browsing through the factors to be reviewed would reveal that the concept covers a wide range of areas. Like the FINSA, the FIL too has two review phases-the 30-day general review and, depending on its outcome, the 60-day special review.

The draft FIL creates an obligation to cooperate on the part of foreign investors-something not expressly stated in the FINSA. It outlines the legal liability of foreign investors for failure to implement the agreed conditions, which could come in the form of fines. The draft law also says the government will not be responsible for losses sustained by foreign investors for failure to apply for national security review.

China's drafting of a consolidated foreign investment law may reflect the country's sincere interest and willingness to continue undertaking the necessary reforms to further attract foreign capital. At the same time, it may suggest the emerging confidence and capacity of local companies, including State-owned enterprises, to compete with their foreign counterparts in the domestic market.

In addition, as Chinese companies expand their global footprint and actively engage in outbound mergers and acquisitions, the government may need to relax restrictions on foreign investments at home and open more sectors for foreign capital, so that Chinese companies receive similar treatment abroad.

At present, the US has more investments in China than the other way round, but in line with the "Go Global" or "Go Out" policy, an increasing number of more Chinese companies are expected to invest in the US in the future. Chinese firms seem to have learned lessons from such setbacks as the botched CNOOC-UNOCAL transaction. A string of successful equity acquisitions across sectors from energy, finance and food, among others, demonstrate the growing sophistication and confidence of Chinese companies in navigating the US legal landscape. These cases are encouraging and may inspire China to adopt similar measures at home in keeping with reciprocity and fairness.

However, the threat of abusing or misusing NSR to block foreign investments especially in a climate of tension or mistrust still lingers. Subjecting a legitimate commercial deal to arbitrary and abusive exercises of NSR may only invite a similar action by the affected state, creating a potential spiral harmful to foreign investments. As such, both countries should make genuine efforts to ensure transparency and consistency in the application of NSR.

The author is an assistant professorial lecturer for international studies at De La Salle University and contributing editor (reviews) for Asian Politics & Policy. Courtesy: China & US Focus

I’ve lived in China for quite a considerable time including my graduate school years, travelled and worked in a few cities and still choose my destination taking into consideration the density of smog or PM2.5 particulate matter in the region.