Which way are emerging markets going to turn?

|

|

A worker at a steel company in Lianyungang, Jiangsu province, in January 2015. [Photo/China Daily] |

Casual observers might think that 2016 was a disappointing year for so-called emerging markets. But the fact is that some of these economies have delivered the year's best investment returns, while certain developed-country markets have fared poorly. If a United Kingdom resident who has personal obligations in Brazil had hedged all of his Brazilian real into pound at the start of the year, he would have lost almost 50 percent of his investment.

Indeed, Brazil is not the only emerging country whose markets performed better than expected in 2016. Yet this is easy to miss when, more than 15 years after I coined the BRIC acronym (Brazil, Russia, India and China), people are still lumping a diverse range of countries into a single "emerging markets" category which confuses more than it illuminates.

This approach makes little sense: there is nothing "emerging" about the Republic of Korea, whose per capita GDP is close to that of the less wealthy eurozone countries; or about China, where the United States' most iconic company, Apple, sells more products than it does in the US itself. Most successful investors probably figured this out some time ago, but others should take note of it in the coming year.

The prevailing emerging-market outlook for 2017 predicts that, under president-elect Donald Trump's incoming administration, the US will expand its fiscal-stimulus policies, and that the US Federal Reserve will tighten monetary policy. This, in turn, will strengthen the dollar, which could create widespread problems in emerging markets.

But there are four reasons to doubt the conventional wisdom. For starters, while markets have performed well in the weeks since Trump's election, investors should be wary of any apparent consensus. No one can confidently predict what shape "Trumponomics" will actually take. Trump's victory was not expected, so much of the strong performance since election day probably reflects adjustments by people who were heavily positioned for the opposite result.

Investors were confident the Fed would raise interest rates in December, and it did so, so those who were pursuing a carry-trade strategy-borrowing dollars to buy currencies that pay higher interest rates-h(huán)ad to reduce their positions. Now, investors are positioned to expect emerging markets to disappoint. Unexpected news about "Trumponomics" might end up producing a positive surprise.

Second, while the decades-long rally in government bonds might finally be coming to an end, it is not obvious that the dollar will remain strong indefinitely, even if it does appreciate relative to other currencies in the near term. I have long believed that the dollar has a natural tendency to appreciate; but there have been plenty of occasions when US policymakers stopped the dollar from strengthening, or even deliberately weakened it.

If Trump wants to restore heavy industry in the US, he will not want a rapidly appreciating dollar. To be sure, many commentators have predicted that "Trumponomics" will resemble "Reaganomics", which had an ostensible aversion to market intervention. But former US president Ronald Reagan's laissez-faire idealism was soon confronted by reality, and in 1985 he agreed to the Plaza Accord, which unleashed a depreciated dollar on global financial markets.

A third consideration for 2017 is that fiscal expansion in the US could benefit commodity producing countries, by strengthening cyclical and global growth. If commodity prices rise, as they have in recent weeks, emerging-market currencies, such as those of Brazil and Chile, could appreciate as their terms of trade (the value of exports relative to imports) move in a positive direction.

Finally, any 2017 forecast must account for China, the emerging-market juggernaut. According to a recent Goldman Sachs research note comparing consensus 2016 forecasts with actual economic performance, China exceeded (albeit modestly) expectations.

China's growth expectations for the coming year are, once again, not particularly optimistic. But if the Chinese economy sustains its slight acceleration since the summer, the rally in Chinese equities will continue as well. Moreover, even if China's overall growth does not accelerate, Chinese consumers' demand for goods and services will continue to increase.

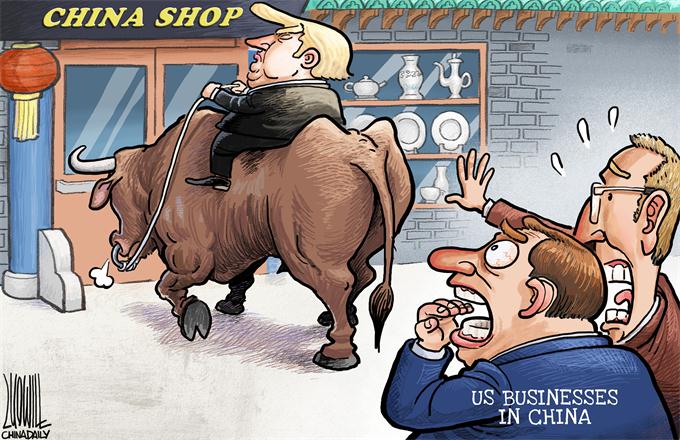

The rise of the Chinese consumer is surely the single most important economic trend in the world today, and trade-bashing populists in the West, such as Trump, would do well to pay attention. Indeed, there could not be a worse time to reduce trade with China, given that the West's largest export sectors now have an opportunity to tap into a massive new market.

Similarly, there will undoubtedly be additional trade and investment opportunities in India, Indonesia, African countries, and perhaps Russia. All told, 2017 will probably not be all that different from 2016: some emerging markets will not provide many investment opportunities, and others could prove to be very lucrative. And, as with Brazil in 2016, some countries' overall economic performance might not be reflected in their markets' performance. The challenge will be to figure out where that is the case.

The author, a former chairman of Goldman Sachs Asset Management and former commercial secretary to the UK Treasury, is honorary professor of Economics at Manchester University and chairman of the British government's Review on Antimicrobial Resistance.

Project Syndicate